Question: please include all steps, solution without Excel, but financial calculator OK 11. Sparrow Corp. has $100 million face value of outstanding debt with a coupon

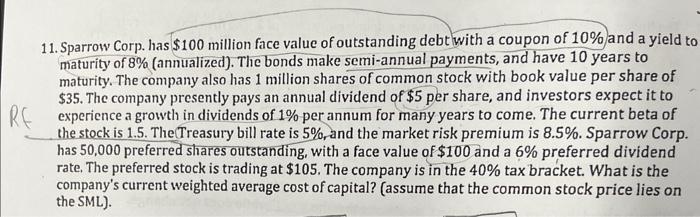

11. Sparrow Corp. has $100 million face value of outstanding debt with a coupon of 10% and a yield to maturity of 8% (annualized). The bonds make semi-annual payments, and have 10 years to maturity. The company also has 1 million shares of common stock with book value per share of $35. The company presently pays an annual dividend of $5 per share, and investors expect it to experience a growth in dividends of 1% per annum for many years to come. The current beta of the stock is 1.5. The Treasury bill rate is 5%, and the market risk premium is 8.5%. Sparrow Corp. has 50,000 preferred shares outstanding, with a face value of $100 and a 6% preferred dividend rate. The preferred stock is trading at $105. The company is in the 40% tax bracket. What is the company's current weighted average cost of capital? [assume that the common stock price lies on the SML)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts