Question: Please include all the details and how to solve Solving for an Annuity Payment 1 2 Present Value 3 Future Value 4 Number of Payments

Please include all the details and how to solve

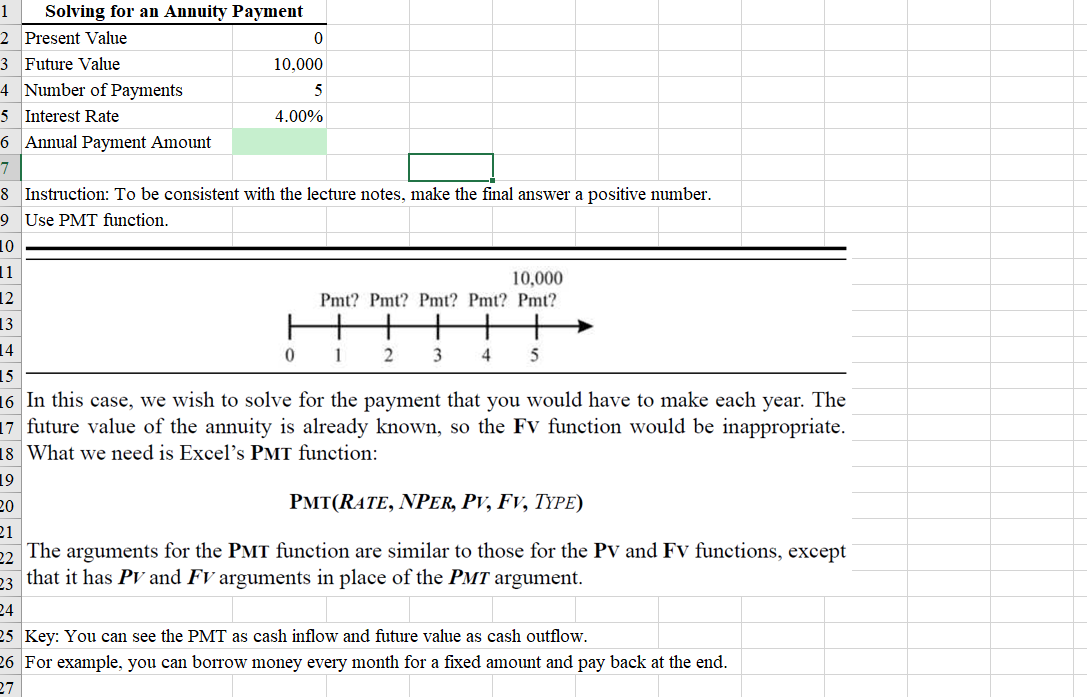

Solving for an Annuity Payment 1 2 Present Value 3 Future Value 4 Number of Payments 10,000 5 5 Interest Rate 4.00% Annual Payment Amount 6 7 8 Instruction: To be consistent with the lecture notes, make the final answer a positive number 9 Use PMT function 10 11 10,000 12 Pmt? Pmt? Pmt? Pmt? Pmt? 13 14 0 2 3 4 5 15 16 In this case, we wish to solve for the payment that you would have to make each year. The 17 future value of the annuity is already known, so the FV function would be inappropriate 18 What we need is Excel's PMT function: 19 (RATE, NPER, PV, Fv, TY) 20 21 2 The arguments for the PMT function are similar to those for the PV and Fv functions, except 23 that it has Pv and FV arguments in place of the PMT argument 24 25 Key: You can see the PMT as cash inflow and future value as cash outflow. 26 For example, you can borrow money every month for a fixed amount and pay back at the end 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts