Question: please include all work Bond FIL 242 Homework #2 Please answer the questions in the space provided below each question. Show all of your work

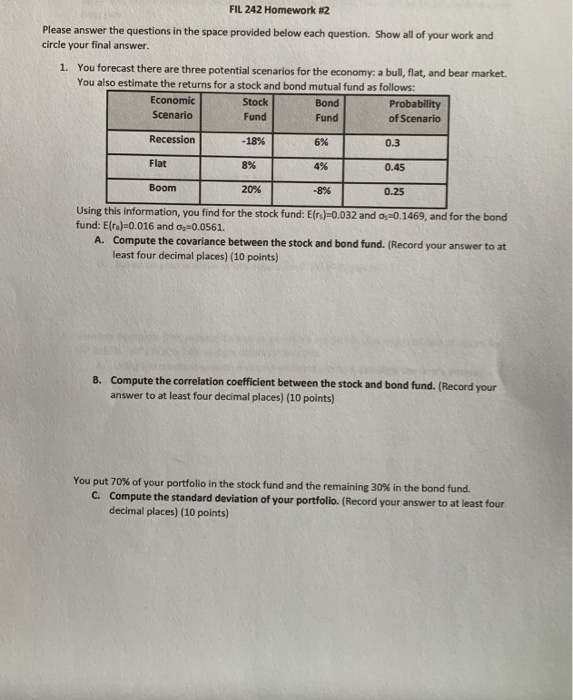

Bond FIL 242 Homework #2 Please answer the questions in the space provided below each question. Show all of your work and circle your final answer. 1. You forecast there are three potential scenarios for the economy: a bull, flat, and bear market. You also estimate the returns for a stock and bond mutual fund as follows: Economic Stock Probability Scenario Fund Fund of Scenario Recession - 18% 6% 0.3 Flat 1 8 % 4% 0.45 Boom -8% 0.25 Using this information, you find for the stock fund: E(13)=0.032 and 0 =0.1469, and for the bond fund: E(ru)=0.016 and o=0.0561. A. Compute the covariance between the stock and bond fund. (Record your answer to at least four decimal places) (10 points) B. Compute the correlation coefficient between the stock and bond fund. (Record your answer to at least four decimal places) (10 points) You put 70% of your portfolio in the stock fund and the remaining 30% in the bond fund. C. Compute the standard deviation of your portfolio. (Record your answer to at least four decimal places) (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts