Question: Please include all working, thankyou. Question 1 Polo Ltd has prepared financial statements and notes to the financial statements for the year ended 30 June

Please include all working, thankyou.

Please include all working, thankyou.

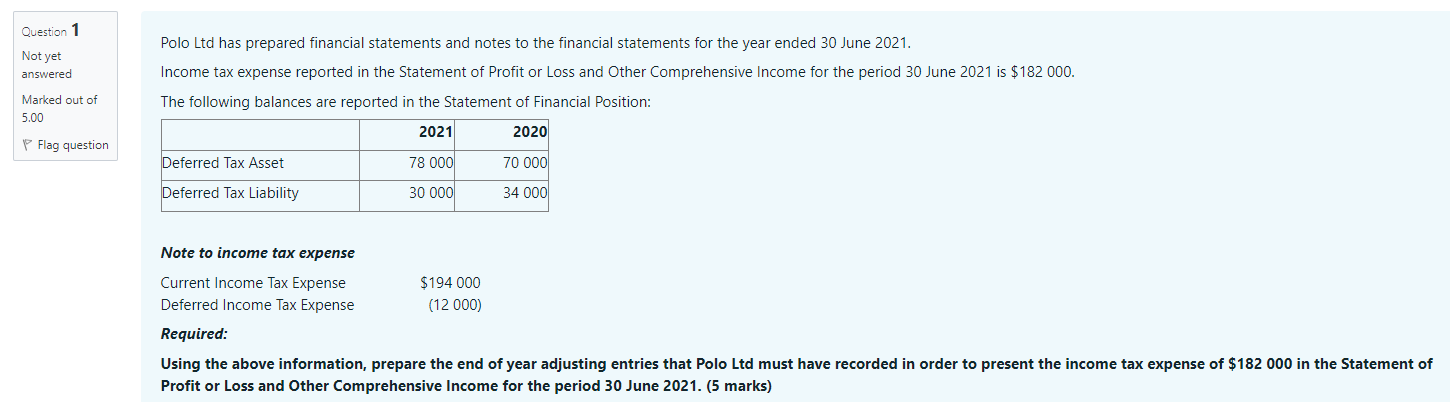

Question 1 Polo Ltd has prepared financial statements and notes to the financial statements for the year ended 30 June 2021. Not yet answered Income tax expense reported in the Statement of Profit or Loss and Other Comprehensive Income for the period 30 June 2021 is $182 000. Marked out of The following balances are reported in the Statement of Financial Position: 5.00 2021 2020 P Flag question Deferred Tax Asset 78 000 70 000 Deferred Tax Liability 30 000 34 000 Note to income tax expense Current Income Tax Expense Deferred Income Tax Expense $194 000 (12 000) Required: Using the above information, prepare the end of year adjusting entries that Polo Ltd must have recorded in order to present the income tax expense of $182 000 in the Statement of Profit or Loss and Other Comprehensive Income for the period 30 June 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts