Question: please include alm formulas used on excel. thank you in advance! Dividend Practice Question Beth Knight, CFA, and David Royal, CFA, are independently analyzing the

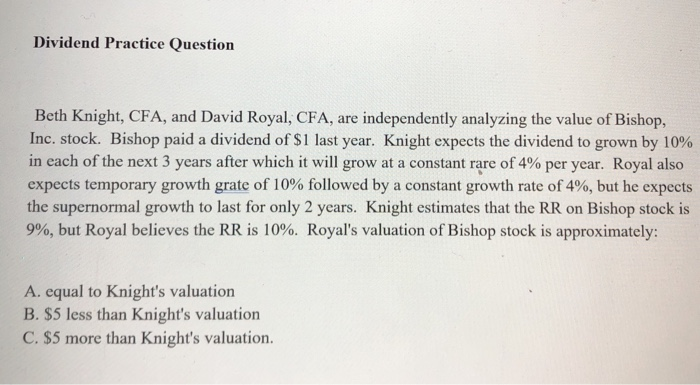

Dividend Practice Question Beth Knight, CFA, and David Royal, CFA, are independently analyzing the value of Bishop, Inc. stock. Bishop paid a dividend of $1 last year. Knight expects the dividend to grown by 10% in each of the next 3 years after which it will grow at a constant rare of 4% per year. Royal also expects temporary growth grate of 10% followed by a constant growth rate of 4%, but he expects the supernormal growth to last for only 2 years. Knight estimates that the RR on Bishop stock is 9%, but Royal believes the RR is 10%. Royal's valuation of Bishop stock is approximately: A. equal to Knight's valuation B. $5 less than Knight's valuation C. $5 more than Knight's valuation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts