Question: *Please include an excel steps formula. Thank you. Given the following information. 10 points Skipped 45% 25 30 Print Percent of capital structure: Debt Preferred

*Please include an excel steps formula. Thank you.

*Please include an excel steps formula. Thank you.

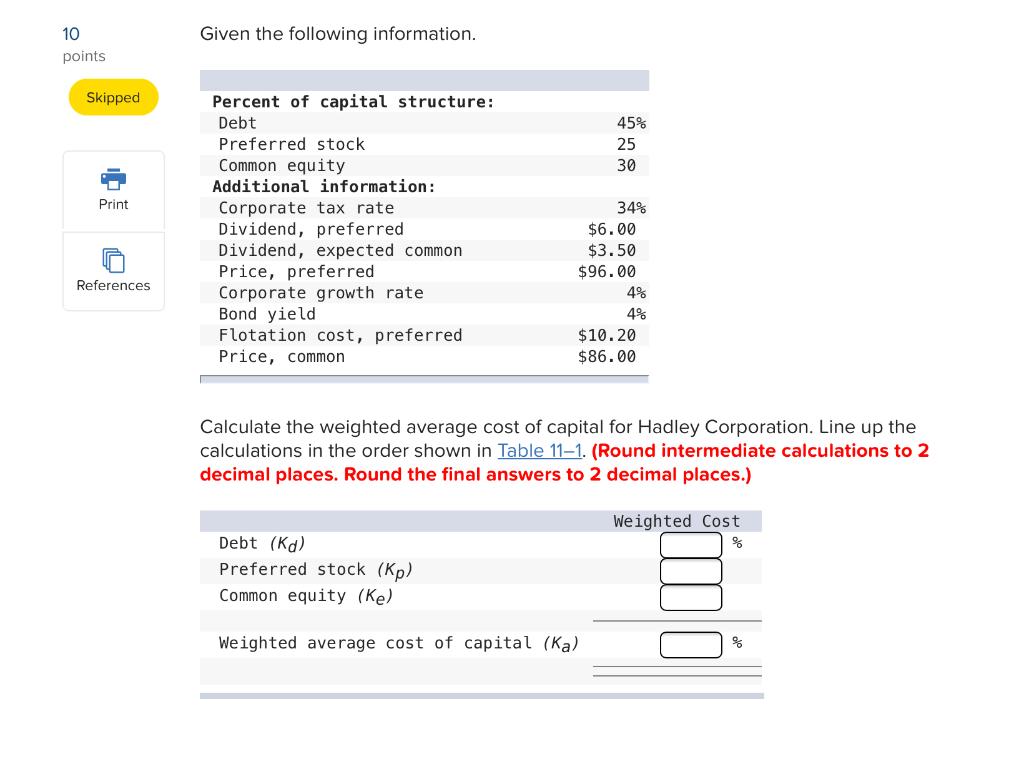

Given the following information. 10 points Skipped 45% 25 30 Print Percent of capital structure: Debt Preferred stock Common equity Additional information: Corporate tax rate Dividend, preferred Dividend, expected common Price, preferred Corporate growth rate Bond yield Flotation cost, preferred Price, common . References 34% $6.00 $3.50 $96.00 4% 4% $10.20 $86.00 Calculate the weighted average cost of capital for Hadley Corporation. Line up the calculations in the order shown in Table 11-1. (Round intermediate calculations to 2 decimal places. Round the final answers to 2 decimal places.) Weighted Cost Debt (ko) Preferred stock (Kp) Common equity (Ke) Weighted average cost of capital (ka) %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts