Question: *Please include an excel steps formula. Thank you. Problem 18-27 (modified) Wilson Pharmaceuticals has done very well in the stock market during the last three

*Please include an excel steps formula. Thank you.

*Please include an excel steps formula. Thank you.

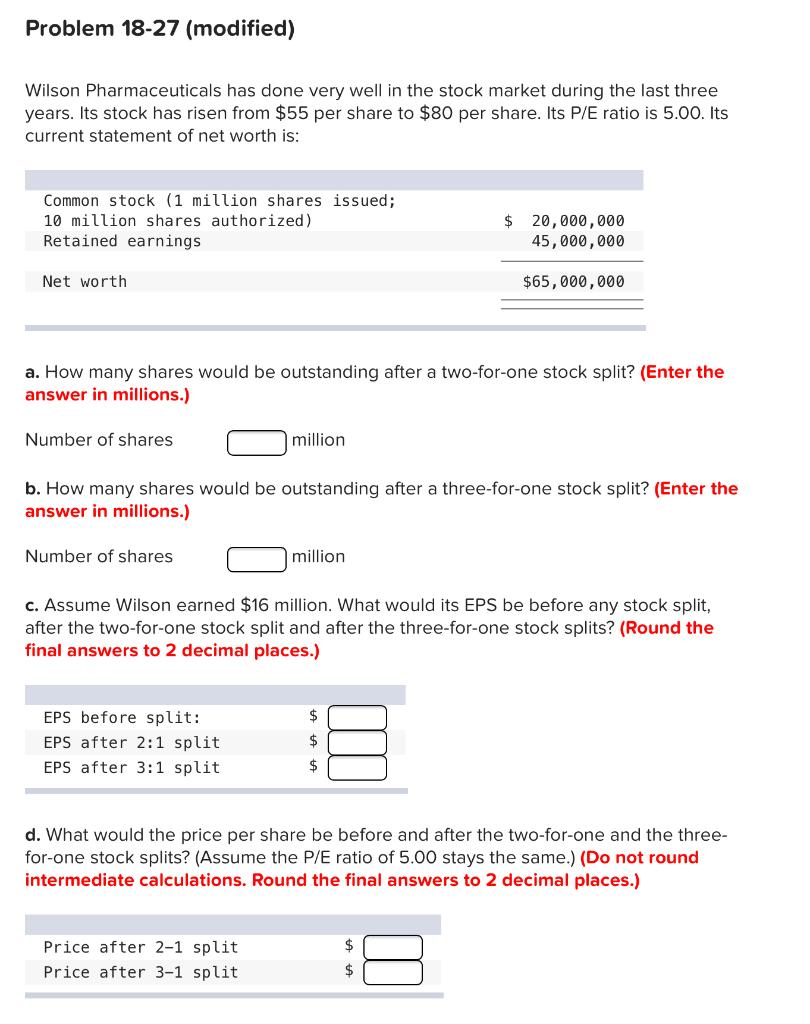

Problem 18-27 (modified) Wilson Pharmaceuticals has done very well in the stock market during the last three years. Its stock has risen from $55 per share to $80 per share. Its P/E ratio is 5.00. Its current statement of net worth is: Common stock (1 million shares issued; 10 million shares authorized) Retained earnings $ 20,000,000 45,000,000 Net worth $65,000,000 a. How many shares would be outstanding after a two-for-one stock split? (Enter the answer in millions.) Number of shares million b. How many shares would be outstanding after a three-for-one stock split? (Enter the answer in millions.) Number of shares million c. Assume Wilson earned $16 million. What would its EPS be before any stock split, after the two-for-one stock split and after the three-for-one stock splits? (Round the final answers to 2 decimal places.) EPS before split: EPS after 2:1 split EPS after 3:1 split $ $ d. What would the price per share be before and after the two-for-one and the three- for-one stock splits? (Assume the P/E ratio of 5.00 stays the same.) (Do not round intermediate calculations. Round the final answers to 2 decimal places.) $ Price after 2-1 split Price after 3-1 split $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts