Question: Please include any additional forms and schedules With Emphasis on Schedule D Matthew Flaws is a single taxpayer and lives at 5670 Sierra Drive, Honolulu,

Please include any additional forms and schedules

Please include any additional forms and schedules

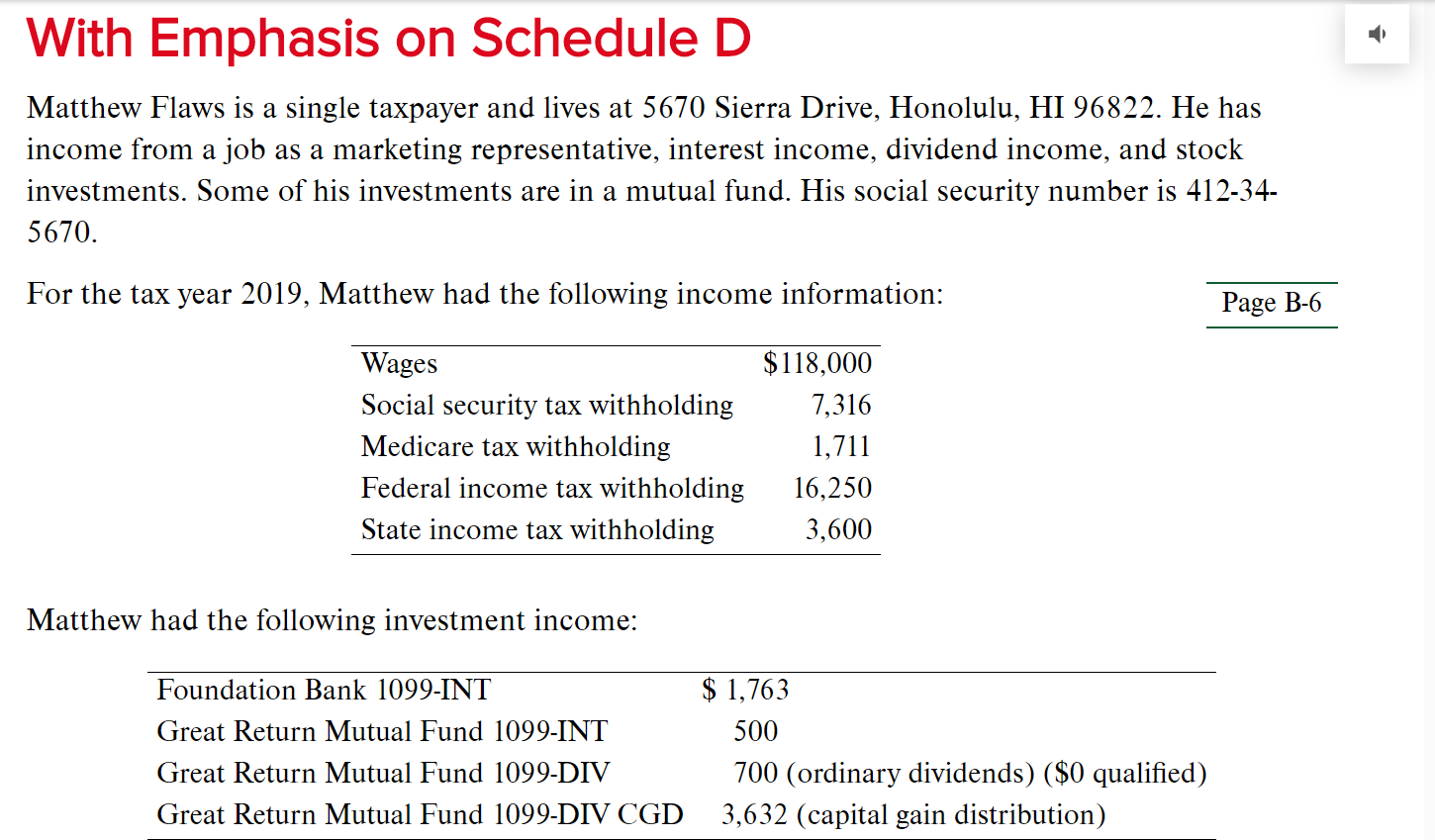

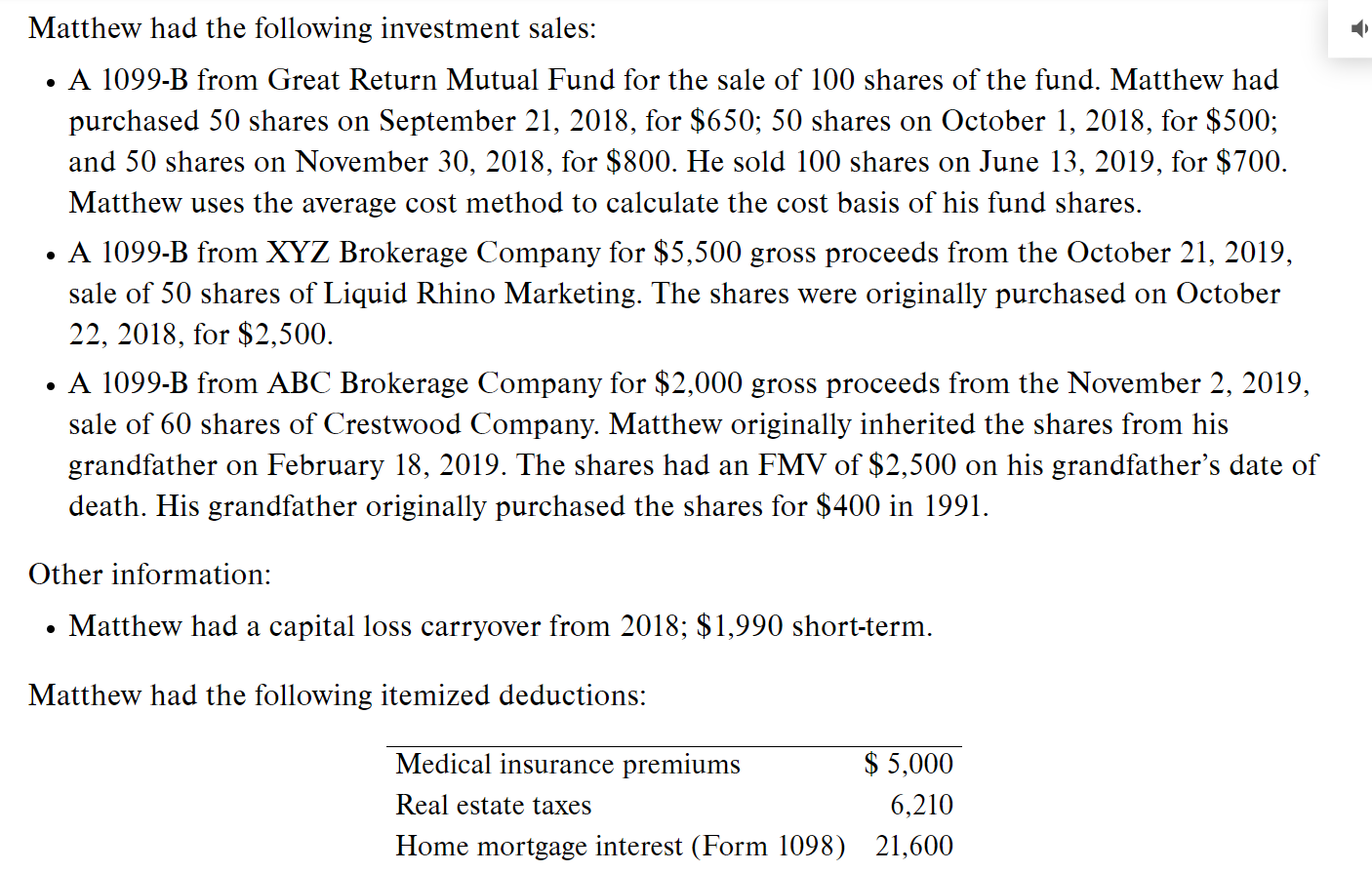

With Emphasis on Schedule D Matthew Flaws is a single taxpayer and lives at 5670 Sierra Drive, Honolulu, HI 96822. He has income from a job as a marketing representative, interest income, dividend income, and stock investments. Some of his investments are in a mutual fund. His social security number is 412-34- 5670. For the tax year 2019, Matthew had the following income information: Page B-6 Wages Social security tax withholding Medicare tax withholding Federal income tax withholding State income tax withholding $ 118,000 7,316 1,711 16,250 3,600 Matthew had the following investment income: Foundation Bank 1099-INT Great Return Mutual Fund 1099-INT Great Return Mutual Fund 1099-DIV Great Return Mutual Fund 1099-DIV CGD $ 1,763 500 700 (ordinary dividends) ($0 qualified) 3,632 (capital gain distribution) D Matthew had the following investment sales: A 1099-B from Great Return Mutual Fund for the sale of 100 shares of the fund. Matthew had purchased 50 shares on September 21, 2018, for $650; 50 shares on October 1, 2018, for $500; and 50 shares on November 30, 2018, for $800. He sold 100 shares on June 13, 2019, for $700. Matthew uses the average cost method to calculate the cost basis of his fund shares. A 1099-B from XYZ Brokerage Company for $5,500 gross proceeds from the October 21, 2019, sale of 50 shares of Liquid Rhino Marketing. The shares were originally purchased on October 22, 2018, for $2,500. A 1099-B from ABC Brokerage Company for $2,000 gross proceeds from the November 2, 2019, sale of 60 shares of Crestwood Company. Matthew originally inherited the shares from his grandfather on February 18, 2019. The shares had an FMV of $2,500 on his grandfather's date of death. His grandfather originally purchased the shares for $400 in 1991. Other information: Matthew had a capital loss carryover from 2018; $1,990 short-term. Matthew had the following itemized deductions: Medical insurance premiums $ 5,000 Real estate taxes 6,210 Home mortgage interest (Form 1098) 21,600 Cash charitable contributions Tax preparation fee 2,000 200 Matthew does not want to contribute to the presidential election campaign and does not want anyone to be a third-party designee. Matthew had qualifying health care coverage at all times during the tax year. Required: Complete the 2019 tax return for Matthew Flaws. For any missing information, make reasonable assumptions. With Emphasis on Schedule D Matthew Flaws is a single taxpayer and lives at 5670 Sierra Drive, Honolulu, HI 96822. He has income from a job as a marketing representative, interest income, dividend income, and stock investments. Some of his investments are in a mutual fund. His social security number is 412-34- 5670. For the tax year 2019, Matthew had the following income information: Page B-6 Wages Social security tax withholding Medicare tax withholding Federal income tax withholding State income tax withholding $ 118,000 7,316 1,711 16,250 3,600 Matthew had the following investment income: Foundation Bank 1099-INT Great Return Mutual Fund 1099-INT Great Return Mutual Fund 1099-DIV Great Return Mutual Fund 1099-DIV CGD $ 1,763 500 700 (ordinary dividends) ($0 qualified) 3,632 (capital gain distribution) D Matthew had the following investment sales: A 1099-B from Great Return Mutual Fund for the sale of 100 shares of the fund. Matthew had purchased 50 shares on September 21, 2018, for $650; 50 shares on October 1, 2018, for $500; and 50 shares on November 30, 2018, for $800. He sold 100 shares on June 13, 2019, for $700. Matthew uses the average cost method to calculate the cost basis of his fund shares. A 1099-B from XYZ Brokerage Company for $5,500 gross proceeds from the October 21, 2019, sale of 50 shares of Liquid Rhino Marketing. The shares were originally purchased on October 22, 2018, for $2,500. A 1099-B from ABC Brokerage Company for $2,000 gross proceeds from the November 2, 2019, sale of 60 shares of Crestwood Company. Matthew originally inherited the shares from his grandfather on February 18, 2019. The shares had an FMV of $2,500 on his grandfather's date of death. His grandfather originally purchased the shares for $400 in 1991. Other information: Matthew had a capital loss carryover from 2018; $1,990 short-term. Matthew had the following itemized deductions: Medical insurance premiums $ 5,000 Real estate taxes 6,210 Home mortgage interest (Form 1098) 21,600 Cash charitable contributions Tax preparation fee 2,000 200 Matthew does not want to contribute to the presidential election campaign and does not want anyone to be a third-party designee. Matthew had qualifying health care coverage at all times during the tax year. Required: Complete the 2019 tax return for Matthew Flaws. For any missing information, make reasonable assumptions

Step by Step Solution

There are 3 Steps involved in it

To complete the 2019 tax return for Matthew Flaws we need to focus on calculating his taxable income ... View full answer

Get step-by-step solutions from verified subject matter experts