Question: Please include any excel formulas Rose Axels faces a smooth annual demand for cash of $5.01 illion, incurs transaction costs of $276 every time the

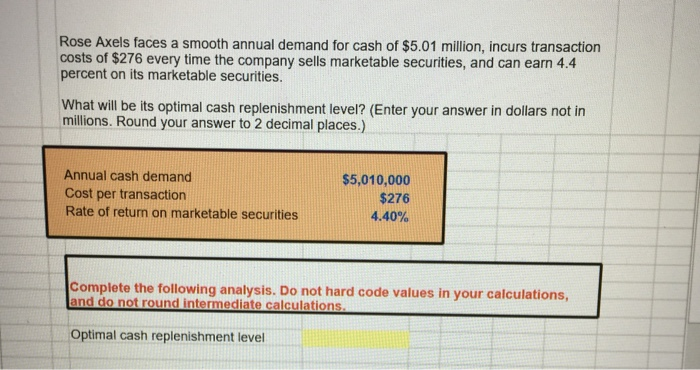

Rose Axels faces a smooth annual demand for cash of $5.01 illion, incurs transaction costs of $276 every time the company sells marketable securities, and can earn 4.4 percent on its marketable securities. What will be its optimal cash replenishment level? (Enter your answer in dollars not in millions. Round your answer to 2 decimal places.) Annual cash demand Cost per transaction Rate of return on marketable securities $5,010,000 $276 4.40% Complete the following analysis. Do not hard code values in your calculations, and do not round intermediate calculations Optimal cash replenishment level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts