Question: Please include brief descriptions of what the model does and how the price fluctuations were analyzed. Last Question: What would the recommendation for Leslie be

Please include brief descriptions of what the model does and how the price fluctuations were analyzed.

Last Question: What would the recommendation for Leslie be based on Part 1 and 2?

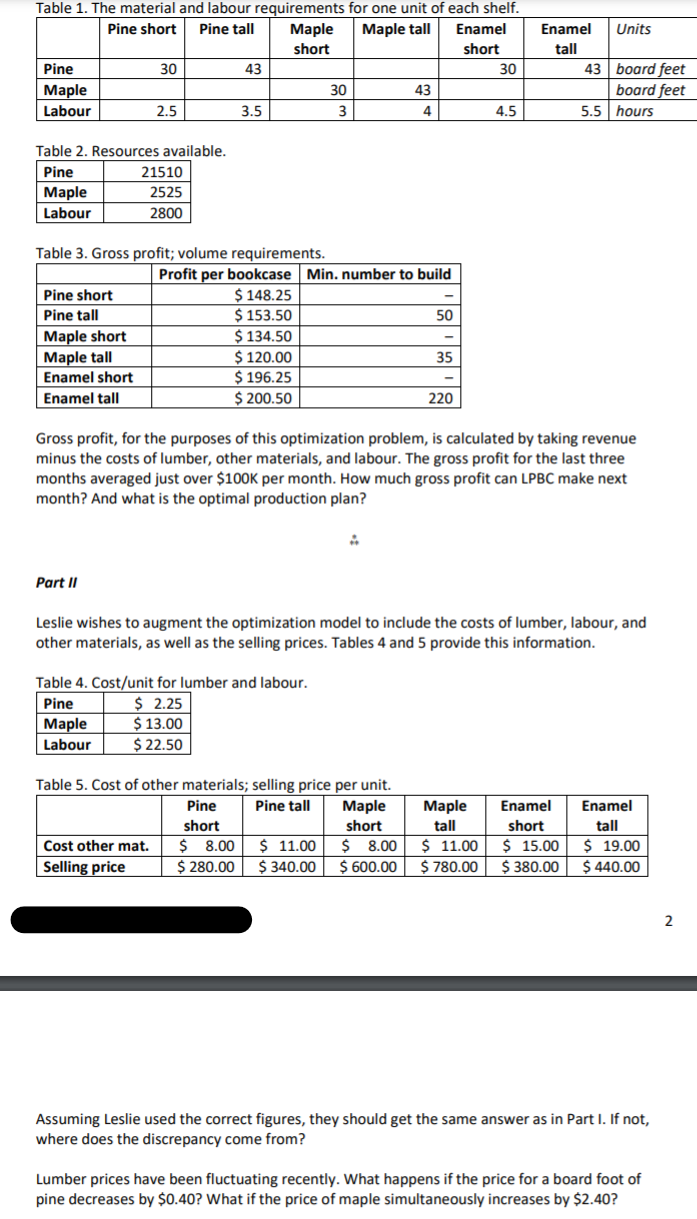

Leslie Presley Bookcase Company A case in four parts When Leslie Presley started building bookcases for friends in their garage, they didn't imagine that one day they'd own and run a company with a global supply chain and a dozen employees. When asked to explain this success, Leslie always replies by saying it is a combination of a passion for excellent woodworking and a background in operations that together helped create the Leslie Presley Bookcase Company (LPBC). LPBC manufactures bookcases in two sizes: short and tall. They come in three finishes: pine, maple, and white enamel. The white enamel bookcases are built out of pine and finished with a waterborne alkyd paint; the other two are finished with boiled linseed oil. The combination of sizes and finishes means there are six products manufactured by the company. Each bookshelf is constructed using 1x12 lumber. A 1x12 board is a piece of wood 1 thick and 12" wide, and can be varying lengths. The total amount of lumber required to construct a bookcase is given in board feet, which describes the total length of boards needed. Leslie finds that demand for these products is strong, and that as long as there are enough tall versions, anything LPBC can manufacture will end up selling. Getting quality lumber materials, however, is sometimes problematic. As well, having enough hours of skilled labour in the Vancouver-based shop can constrain production. Part I: Staring out the window at the rainy Vancouver weather and thinking about production for the upcoming month, Leslie realizes that an optimization model might help increase profits. Tables 1, 2, and 3 provide the data required to create a linear program to figure out how many of each product to manufacture next month. Assume that a non-integer solution is not a concern for LPBC (e.g., perhaps non-integer values could simply be rounded up or down when it comes time to implement the plan. Table 1. The material and labour requirements for one unit of each shelf. Pine short Pine tall Maple Maple tall Enamel short short Pine 30 43 30 Maple 30 43 Labour 2.5 3.5 3 4 4.5 Enamel Units tall 43 | board feet board feet 5.5 hours Table 2. Resources available. Pine 21510 Maple 2525 Labour 2800 Table 3. Gross profit; volume requirements. Profit per bookcase Min. number to build Pine short $ 148.25 Pine tall $ 153.50 50 Maple short $ 134.50 Maple tall $ 120.00 35 Enamel short $ 196.25 Enamel tall $ 200.50 220 Gross profit, for the purposes of this optimization problem, is calculated by taking revenue minus the costs of lumber, other materials, and labour. The gross profit for the last three months averaged just over $100K per month. How much gross profit can LPBC make next month? And what is the optimal production plan? Part II Leslie wishes to augment the optimization model to include the costs of lumber, labour, and other materials, as well as the selling prices. Tables 4 and 5 provide this information. Table 4. Cost/unit for lumber and labour. Pine $ 2.25 Maple $ 13.00 Labour $ 22.50 Table 5. Cost of other materials; selling price per unit. Pine Pine tall Maple short short Cost other mat. $ 8.00 $ 11.00 $ 8.00 Selling price $280.00 $ 340.00 $ 600.00 Maple tall $ 11.00 $ 780.00 Enamel short $ 15.00 $ 380.00 Enamel tall $ 19.00 $ 440.00 2 Assuming Leslie used the correct figures, they should get the same answer as in Part I. If not, where does the discrepancy come from? Lumber prices have been fluctuating recently. What happens if the price for a board foot of pine decreases by $0.40? What if the price of maple simultaneously increases by $2.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts