Question: Please include calculations for each answer and in table form ( picture ) and I will give thumbs up . Thank you! Perfect Parties, Inc.

Please include calculations for each answer and in table form picture and I will give thumbs up Thank you!

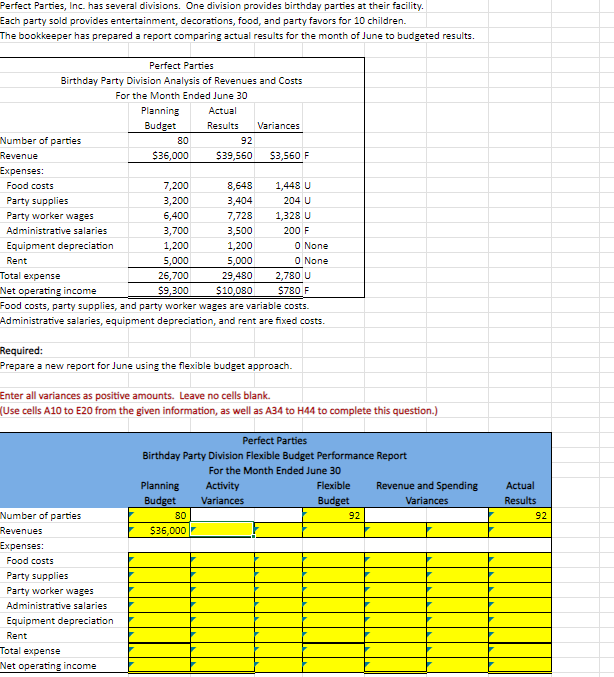

Perfect Parties, Inc. has several divisions. One division provides birthday parties at their facility.Each party sold provides entertainment, decorations, food, and party favors for children.The bookkeeper has prepared a report comparing actual results for the month of June to budgeted results.Perfect PartiesBirthday Party Division Analysis of Revenues and CostsFor the Month Ended June Planning BudgetActual ResultsVariancesNumber of partiesRevenue$$$FExpenses:Food costsUParty suppliesUParty worker wagesUAdministrative salariesFEquipment depreciationNoneRentNoneTotal expenseUNet operating income$$$FFood costs, party supplies, and party worker wages are variable costs.Administrative salaries, equipment depreciation, and rent are fixed costs.Required:Prepare a new report for June using the flexible budget approach.Enter all variances as positive amounts. Leave no cells blank.Use cells A to E from the given information, as well as A to H to complete this question.Perfect PartiesBirthday Party Division Flexible Budget Performance ReportFor the Month Ended June Planning BudgetActivity VariancesFlexible BudgetRevenue and Spending VariancesActual ResultsNumber of partiesRevenuesExpenses:Food costsParty suppliesParty worker wagesAdministrative salariesEquipment depreciationRentTotal expenseNet operating income

Perfect Parties, Inc. has several divisions. One division provides birthday parties at their facility.

Each party sold provides entertainment, decorations, food, and party favors for children.

The bookkeeper has prepared a report comparing actual results for the month of June to budgeted results.

Food costs, party supplies, and party worker wages are variable costs.

Administrative salaries, equipment depreciation, and rent are fixed costs.

Enter all variances as positive amounts. Leave no cells blank.

Use cells A to E from the given information, as well as A to H to complete this question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock