Question: Please include calculations Instructions Marshall Inc Comparative Retained Eamings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 2 Retained earnings, January

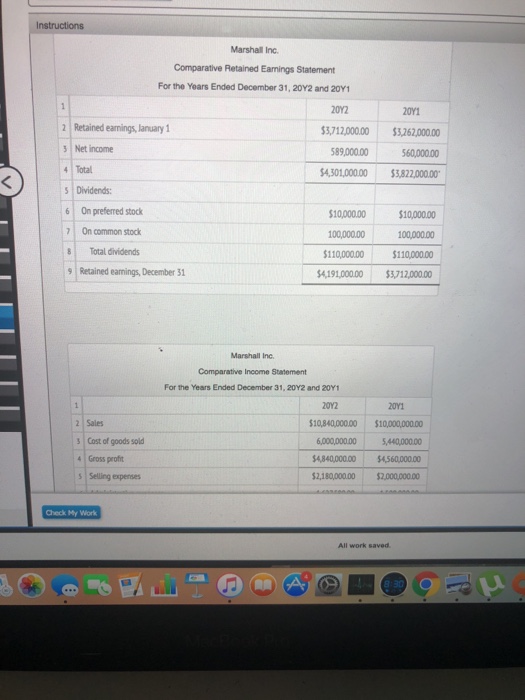

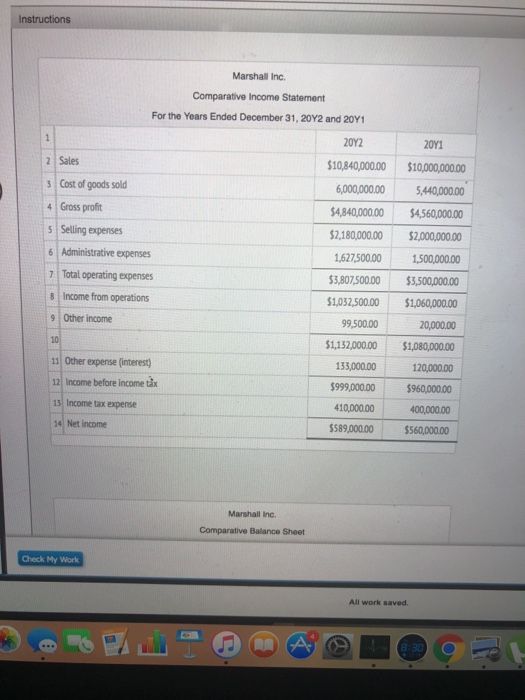

Instructions Marshall Inc Comparative Retained Eamings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 2 Retained earnings, January 1 3,712000.00 $3262,000.00 60,000.00 4,301,000.00 $3,822,000.00 3 Net income 589,000.00 Total Dividends: 6 On preferred stock 7 On common stock 8Total dividends 10,000.00 $10,000.00 100,000.00 110,000.00 $110,000.00 4,191,000.00 $3,712,000.00 100,000.00 Retained earmings, December 31 Marshall Inc Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales 10,840,000.00 $10,000,000.00 6,000,00000 5,440,000.00 4,840,000.00 $4,560,000.00 2,180,000.00 $2,000,000.00 3 Cost of goods sold 4 Gross prof s Selling expenses Check My Work

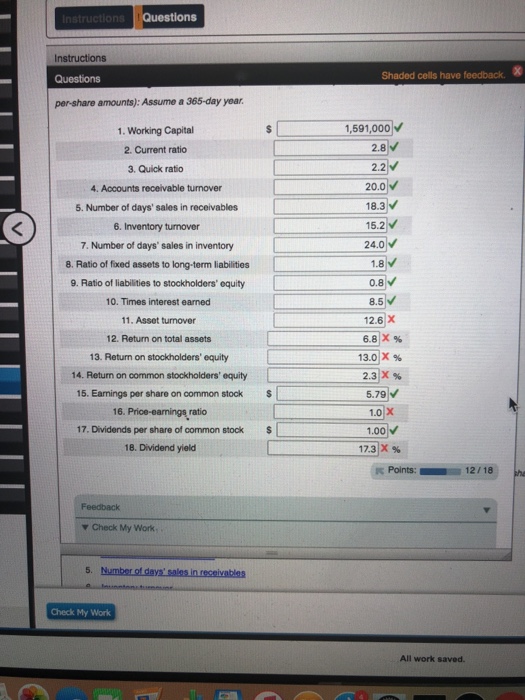

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts