Question: PLEASE INCLUDE CALCULATIONS Problem 8 - 3 8 ( LO . 2 , 3 , 9 ) Lori, who is single, purchased and placed in

PLEASE INCLUDE CALCULATIONS

Problem LO

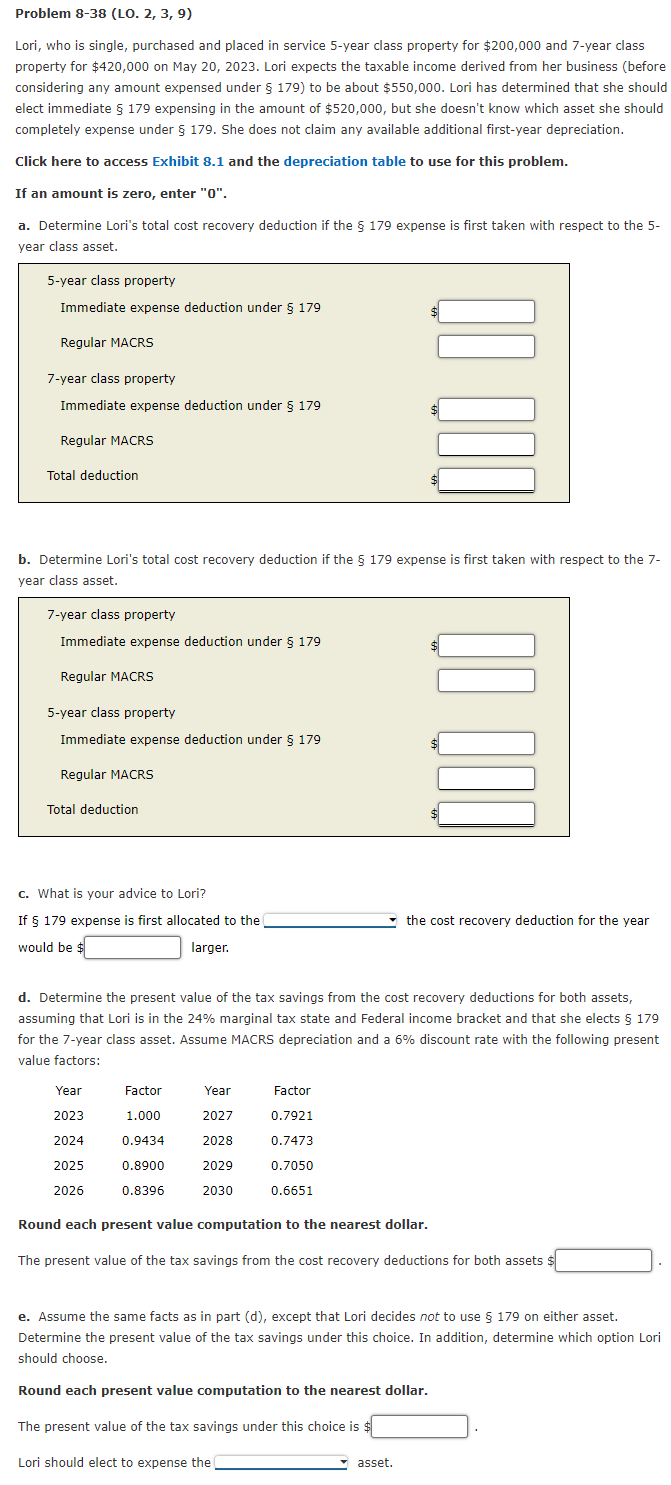

Lori, who is single, purchased and placed in service year class property for $ and year class property for $ on May Lori expects the taxable income derived from her business before considering any amount expensed under to be about $ Lori has determined that she should elect immediate expensing in the amount of $ but she doesn't know which asset she should completely expense under She does not claim any available additional firstyear depreciation.

Click here to access Exhibit and the depreciation table to use for this problem.

If an amount is zero, enter

Question Content Area

aDetermine Lori's total cost recovery deduction if the expense is first taken with respect to the year class asset.

year class propertyImmediate expense deduction under $fill in the blank cfcfRegular MACRSfill in the blank cfcfyear class propertyImmediate expense deduction under $fill in the blank cfcfRegular MACRSfill in the blank cfcfTotal deduction$fill in the blank cfcf

Question Content Area

bDetermine Lori's total cost recovery deduction if the expense is first taken with respect to the year class asset.

year class propertyImmediate expense deduction under $fill in the blank ecaRegular MACRSfill in the blank ecayear class propertyImmediate expense deduction under $fill in the blank ecaRegular MACRSfill in the blank ecaTotal deduction$fill in the blank eca

Question Content Area

cWhat is your advice to Lori?

If expense is first allocated to the

fiveyearsevenyear

the cost recovery deduction for the year would be $fill in the blank befdcfdf larger.

Question Content Area

dDetermine the present value of the tax savings from the cost recovery deductions for both assets, assuming that Lori is in the marginal tax state and Federal income bracket and that she elects for the year class asset. Assume MACRS depreciation and a discount rate with the following present value factors:

YearFactorYearFactor

Round each present value computation to the nearest dollar.

The present value of the tax savings from the cost recovery deductions for both assets $fill in the blank dcfcff

Question Content Area

eAssume the same facts as in part d except that Lori decides not to use on either asset. Determine the present value of the tax savings under this choice. In addition, determine which option Lori should choose.

Round each present value computation to the nearest dollar.

The present value of the tax savings under this choice is $fill in the blank fbfaf

Lori should elect to expense the

yearyear

asset.

Lori, who is single, purchased and placed in service year class property for $ and year class

property for $ on May Lori expects the taxable income derived from her business before

considering any amount expensed under to be about $ Lori has determined that she should

elect immediate expensing in the amount of $ but she doesn't know which asset she should

completely expense under She does not claim any available additional firstyear depreciation.

Click here to access Exhibit and the depreciation table to use for this problem.

If an amount is zero, enter

a Determine Lori's total cost recovery deduction if the expense is first taken with respect to the

year class asset.

b Determine Lori's total cost recovery deduction if the expense is first taken with respect to the

year class asset.

c What is your advice to Lori?

If expense is first allocated to the

the cost recovery deduction for the year

would be $

larger.

d Determine the present value of the tax savings from the cost recovery deductions for both assets,

assuming that Lori is in the marginal tax state and Federal income bracket and that she elects

for the year class asset. Assume MACRS depreciation and a discount rate with the following present

value factors:

Round each present value computation to the nearest dollar.

The present value of the tax savings from the cost recovery deductions for both assets $

e Assume the same facts as in part d except that Lori decides not to use on either asset.

Determine the present value of the tax savings under this choice. In addition, determine which option Lori

should choose.

Round each present value computation to the nearest dollar.

The present value of the tax savings under this choice is :

Lori should elect to expense the

asset.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock