Question: please include cell references -3 Calculate the price and Duration of a 5 Year, Semiannual Bond with a Coupon Rate of 5% and an Annual

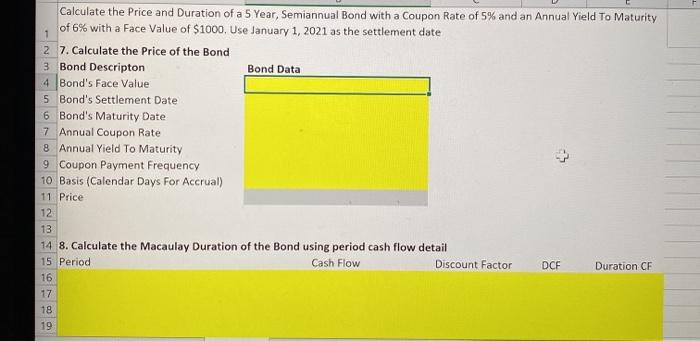

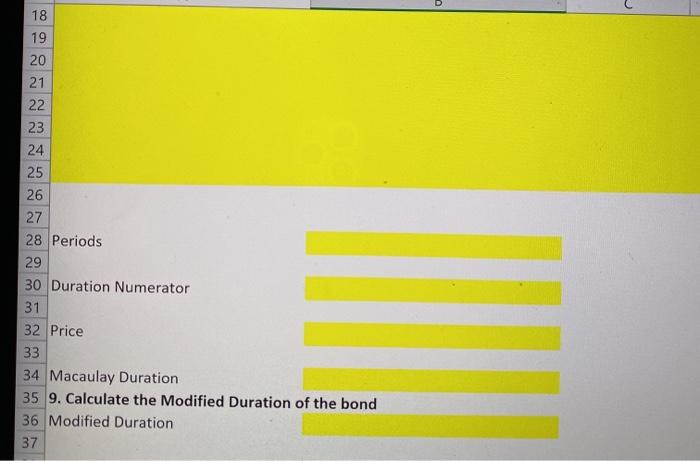

-3 Calculate the price and Duration of a 5 Year, Semiannual Bond with a Coupon Rate of 5% and an Annual Yield To Maturity of 6% with a Face Value of $1000, Use January 1, 2021 as the settlement date 1 2 7. Calculate the price of the Bond 3 Bond Descripton Bond Data 4 Bond's Face Value 5 Bond's Settlement Date 6 Bond's Maturity Date 7 Annual Coupon Rate 8 Annual Yield To Maturity 9 Coupon Payment Frequency 10 Basis (Calendar Days For Accrual) 11 Price 12 13 14 8. Calculate the Macaulay Duration of the Bond using period cash flow detail 15 Period Cash Flow Discount Factor DCF Duration CF 16 17 18 19 18 2 19 20 21 22 23 24 25 26 27 28 Periods 29 30 Duration Numerator 31 32 Price 33 34 Macaulay Duration 35 9. Calculate the Modified Duration of the bond 36 Modified Duration 37 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts