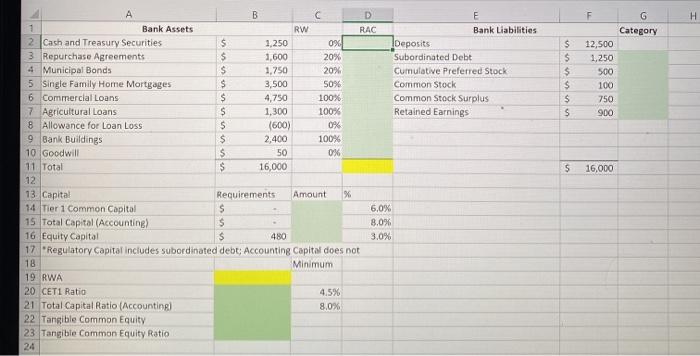

Question: please include cell references F H G Category S $ $ $ S s 12,500 1.250 500 100 750 900 s 16,000 B C D

F H G Category S $ $ $ S s 12,500 1.250 500 100 750 900 s 16,000 B C D E Bank Assets RW RAC Bank Liabilities 2 Cash and Treasury Securities $ 1,250 0% Deposits 3 Repurchase Agreements $ 1,600 20% Subordinated Debt 4 Municipal Bonds $ 1,750 20% Cumulative Preferred Stock 5 Single Family Home Mortgages $ 3,500 50% Common Stock 6 Commercial Loans $ 4,750 100% Common Stock Surplus 7 Agricultural Loans S 1,300 100% Retained Earnings 8 Allowance for Loan Loss S (600) 0% 9 Bank Buildings $ 2,400 100% 10 Goodwill $ 50 0% 11 Total $ 16,000 12 13 Capital Requirements Amount % 14 Tier 1 Common Capital $ 6,0% 15 Total Capital (Accounting) $ 8.0% 16 Equity Capital $ 480 3.0% 17. "Regulatory Capital includes subordinated debt: Accounting Capital does not 18 Minimum 19 RWA 20 CET1 Ratio 4.5% 21 Total Capital Ratio (Accounting) 8.0% 22 Tangible Common Equity 23 Tangible Common Equity Ratio 24 F H G Category S $ $ $ S s 12,500 1.250 500 100 750 900 s 16,000 B C D E Bank Assets RW RAC Bank Liabilities 2 Cash and Treasury Securities $ 1,250 0% Deposits 3 Repurchase Agreements $ 1,600 20% Subordinated Debt 4 Municipal Bonds $ 1,750 20% Cumulative Preferred Stock 5 Single Family Home Mortgages $ 3,500 50% Common Stock 6 Commercial Loans $ 4,750 100% Common Stock Surplus 7 Agricultural Loans S 1,300 100% Retained Earnings 8 Allowance for Loan Loss S (600) 0% 9 Bank Buildings $ 2,400 100% 10 Goodwill $ 50 0% 11 Total $ 16,000 12 13 Capital Requirements Amount % 14 Tier 1 Common Capital $ 6,0% 15 Total Capital (Accounting) $ 8.0% 16 Equity Capital $ 480 3.0% 17. "Regulatory Capital includes subordinated debt: Accounting Capital does not 18 Minimum 19 RWA 20 CET1 Ratio 4.5% 21 Total Capital Ratio (Accounting) 8.0% 22 Tangible Common Equity 23 Tangible Common Equity Ratio 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts