Question: Please include clear and precise steps as I would like to know how to solve this. Thank you. CF Inc. is planning to purchase a

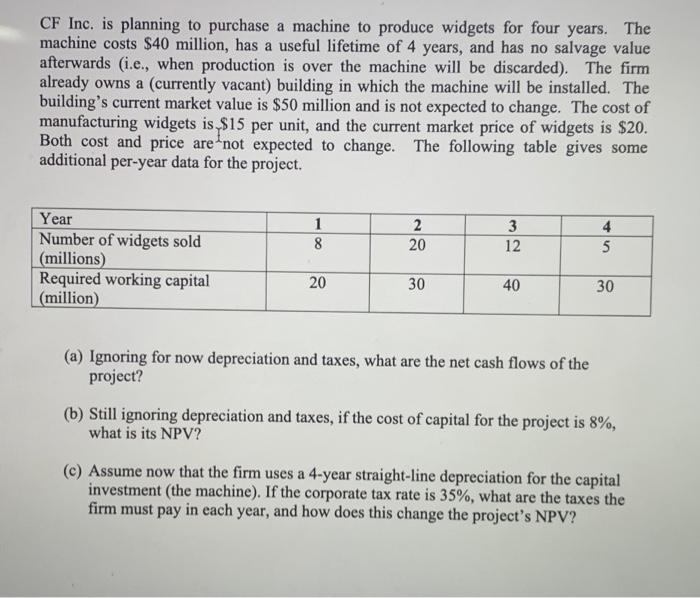

CF Inc. is planning to purchase a machine to produce widgets for four years. The machine costs $40 million, has a useful lifetime of 4 years, and has no salvage value afterwards (i.e., when production is over the machine will be discarded). The firm already owns a (currently vacant) building in which the machine will be installed. The building's current market value is $50 million and is not expected to change. The cost of manufacturing widgets is $15 per unit, and the current market price of widgets is $20. Both cost and price are 1 not expected to change. The following table gives some additional per-year data for the project. (a) Ignoring for now depreciation and taxes, what are the net cash flows of the project? (b) Still ignoring depreciation and taxes, if the cost of capital for the project is 8%, what is its NPV? (c) Assume now that the firm uses a 4-year straight-line depreciation for the capital investment (the machine). If the corporate tax rate is 35%, what are the taxes the firm must pay in each year, and how does this change the project's NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts