Question: please include clear step by step instruction for each calculation.Ex: step 1- solve for X. step 2- solve for Y etc. Thank you for your

please include clear step by step instruction for each calculation.Ex: step 1- solve for X. step 2- solve for Y etc. Thank you for your help!

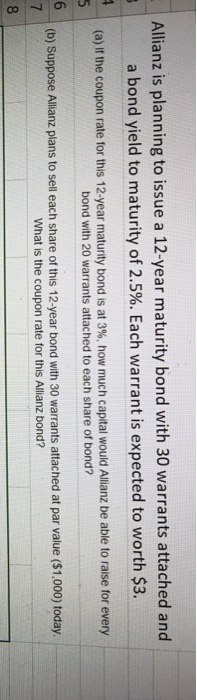

please include clear step by step instruction for each calculation.Ex: step 1- solve for X. step 2- solve for Y etc. Thank you for your help! Allianz is planning to issue a 12-year maturity bond with 30 warrants attached and 5 a bond yield to maturity of 2.5%. Each warrant is expected to worth $3. 4 (a) if the coupon rate for this 12-year maturity bond is at 3%, how much capital would Allianz be able to raise for every 5 bond with 20 warrants attached to each share of bond? 6 (b) Suppose Allianz plans to sell each share of this 12-year bond with 30 warrants attached at par value ($1,000) today. 7 What is the coupon rate for this Allianz bond? 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts