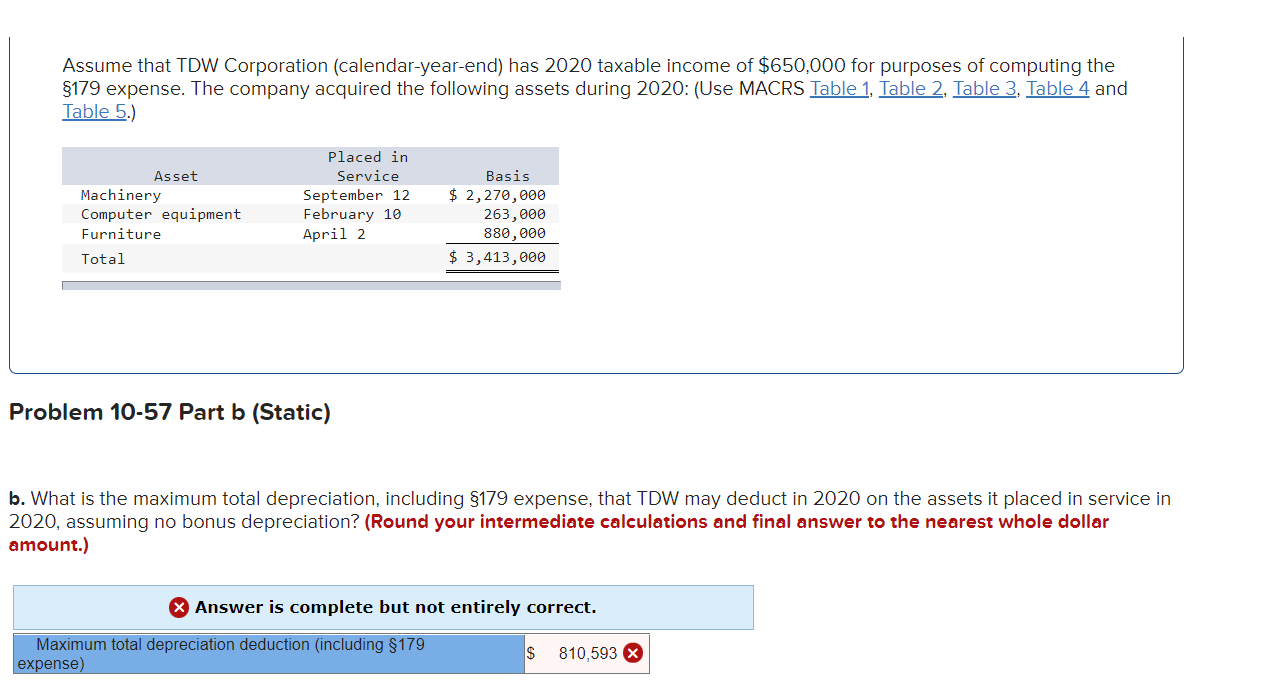

Question: Please include detailed explanations to help me understand your solution. Thanks Assume that TDW Corporation (calendar-year-end) has 2020 taxable income of $650,000 for purposes of

Please include detailed explanations to help me understand your solution. Thanks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts