Question: Please Include Detailed Steps as to how you would arrive to the answer! Question 13 0/7 pts Today you buy a Wal-Mart bond with $10,000

Please Include Detailed Steps as to how you would arrive to the answer!

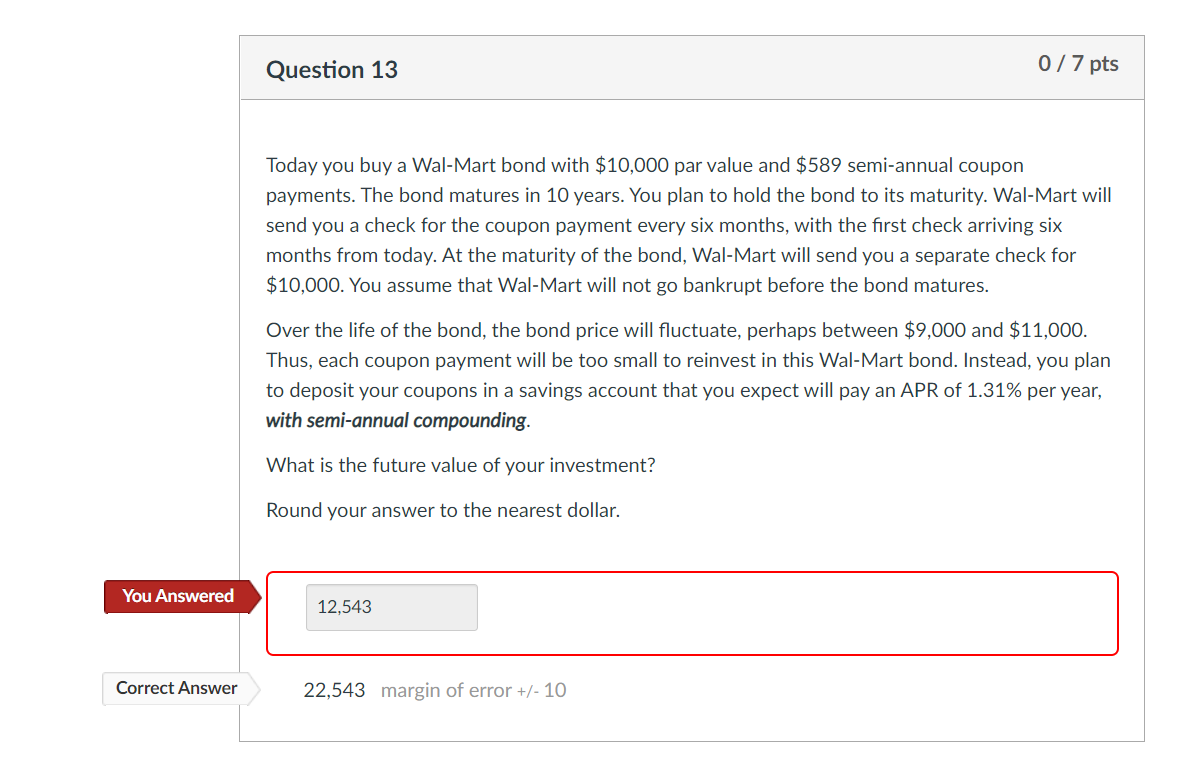

Question 13 0/7 pts Today you buy a Wal-Mart bond with $10,000 par value and $589 semi-annual coupon payments. The bond matures in 10 years. You plan to hold the bond to its maturity. Wal-Mart will send you a check for the coupon payment every six months, with the first check arriving six months from today. At the maturity of the bond, Wal-Mart will send you a separate check for $10,000. You assume that Wal-Mart will not go bankrupt before the bond matures. Over the life of the bond, the bond price will fluctuate, perhaps between $9,000 and $11,000. Thus, each coupon payment will be too small to reinvest in this Wal-Mart bond. Instead, you plan to deposit your coupons in a savings account that you expect will pay an APR of 1.31% per year, with semi-annual compounding. What is the future value of your investment? Round your answer to the nearest dollar. You Answered 12,543 Correct Answer 22,543 margin of error +/- 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts