Question: Please include details on how to calculate NPV for each option 3. Data Corp needs to buy new equipment to pursue new business lines in

Please include details on how to calculate NPV for each option

Please include details on how to calculate NPV for each option

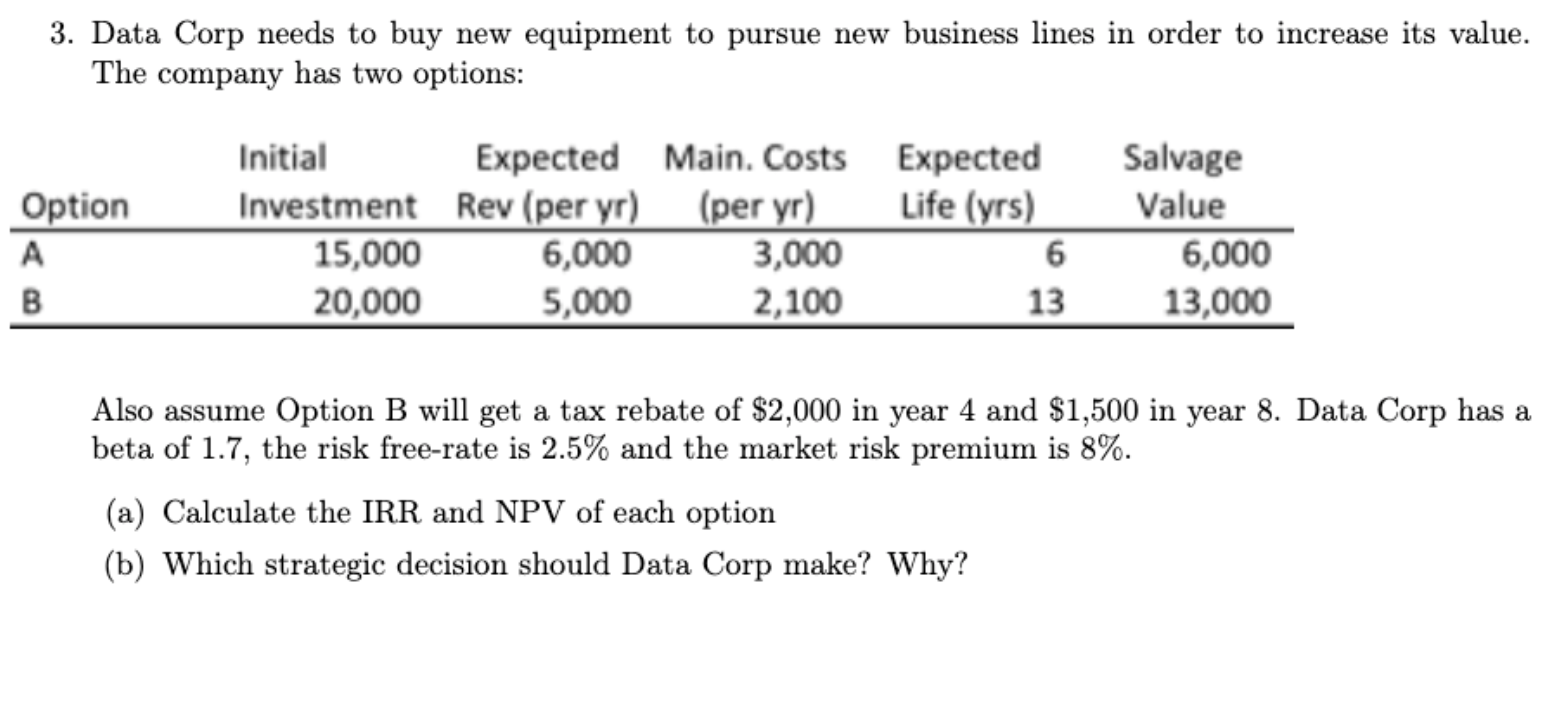

3. Data Corp needs to buy new equipment to pursue new business lines in order to increase its value. The company has two options: Option Initial Expected Investment Rev (per yr) 15,000 6,000 20.000 5.000 Main. Costs (per yr) 3,000 2.100 Expected Life (yrs) 6 13 Salvage Value 6,000 13.000 Also assume Option B will get a tax rebate of $2,000 in year 4 and $1,500 in year 8. Data Corp has a beta of 1.7, the risk free-rate is 2.5% and the market risk premium is 8%. (a) Calculate the IRR and NPV of each option (b) Which strategic decision should Data Corp make? Why

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock