Question: Please include excel equations Acompany is evaluating a project where an investor has committed to 10 year contract paying $2 milion a year, which starts

Please include excel equations

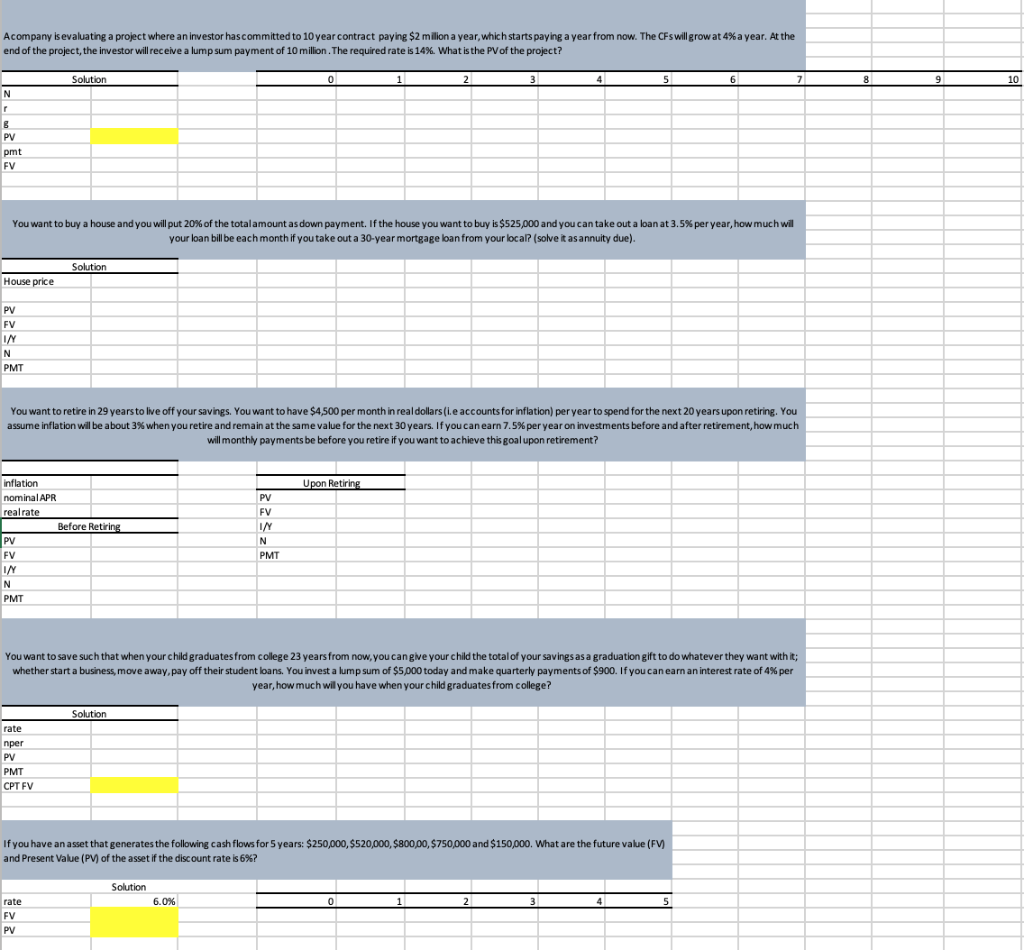

Acompany is evaluating a project where an investor has committed to 10 year contract paying $2 milion a year, which starts paying a year from now. The CFs will grow at 4% a year. At the end of the project, the investor will receive a lump sum payment of 10 million. The required rate is 14%. What is the PV of the project? 0 1 2 3 4 9 10 N PV pmt FV You want to buy a house and you will put 20% of the total amount as down payment. If the house you want to buy is $525,000 and you can take out a loan at 3.5% per year, how much wil your loan bill be each month if you take out a 30-year mortgage loan from your local? (solve it as annuity due). Solution House price PV FV IN N PMT You want to retire in 29 years to live off your savings. You want to have $4,500 per month in real dollars(i.e accounts for inflation) per year to spend for the next 20 years upon retiring. You assume inflation will be about 3% when you retire and remain at the same value for the next 30 years. If you can earn 7.5% per year on investments before and after retirement, how much will monthly payments be before you retire if you want to achieve this goal upon retirement? Upon Retiring PV FV INY inflation nominal APR realrate Before Retiring PV FV IN N PMT N PMT You want to save such that when your child graduates from college 23 years from now, you can give your child the total of your savings as a graduation gift to do whatever they want with it; whether start a business, move away, pay off their student loans. You invest a lump sum of $5,000 today and make quarterly payments of $900. If you can earn an interest rate of 4% per year, how much will you have when your child graduates from college? Solution rate nper PV PMT CPT FV If you have an asset that generates the following cash flows for 5 years: $250,000,$520,000,$800,00, $750,000 and $150,000. What are the future value (FV) and Present Value (PV) of the asset if the discount rate is 6%? Solution 0 1 2 3 4 5 rate FV PV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts