Question: please include excel formulas D H K 1 2 Question 3 (80 Points) 3 HyperBlend Company, a manufacturer of blenders, is considering a new project

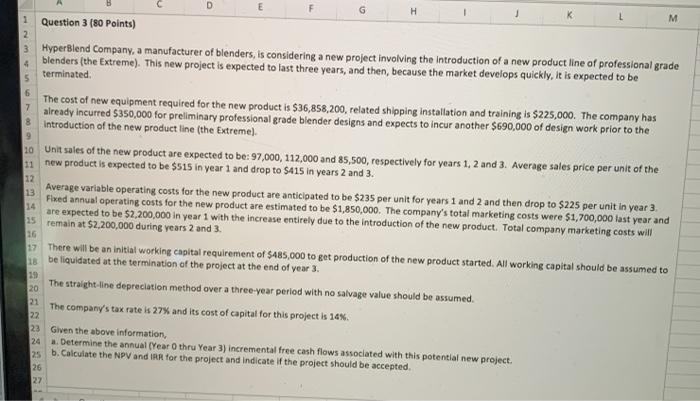

D H K 1 2 Question 3 (80 Points) 3 HyperBlend Company, a manufacturer of blenders, is considering a new project involving the introduction of a new product line of professional grade blenders (the Extreme). This new project is expected to last three years, and then, because the market develops quickly, it is expected to be 4 terminated 5 6 7 9 12 14 The cost of new equipment required for the new product is $36,858,200, related shipping installation and training is $225,000. The company has already incurred 5350,000 for preliminary professional grade blender designs and expects to incur another $690,000 of design work prior to the Introduction of the new product line (the Extreme). 20 Unit sales of the new product are expected to be:97,000, 112,000 and 85,500, respectively for years 1, 2 and 3. Average sales price per unit of the 11 new product is expected to be $515 in year 1 and drop to $415 in years 2 and 3. Average variable operating costs for the new product are anticipated to be $235 per unit for years 1 and 2 and then drop to $225 per unit in year 3, 13 Fixed annual operating costs for the new product are estimated to be $1,850,000. The company's total marketing costs were $1,700,000 last year and are expected to be $2,200,000 in year 1 with the increase entirely due to the introduction of the new product. Total company marketing costs will 15 remain at 52,200,000 during years 2 and 3. 16 17 There will be an initial working capital requirement of $485,000 to get production of the new product started. All working capital should be assumed to 18 be liquidated at the termination of the project at the end of year 3. The straight-line depreciation method over a three-year period with no salvage value should be assumed. The company's tax rate is 27% and its cost of capital for this project is 14%. 23 Given the above information, Determine the annual Year Othru Year 3) incremental free cash flows associated with this potential new project. 28 b. Calculate the NPV and IRA for the project and indicate if the project should be accepted. 19 20 21 22 24 26 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts