Question: Please include excel formulas JTM Airlines, where you work, is looking at potentially buying more gates at their home airport. If it pays the airport

Please include excel formulas

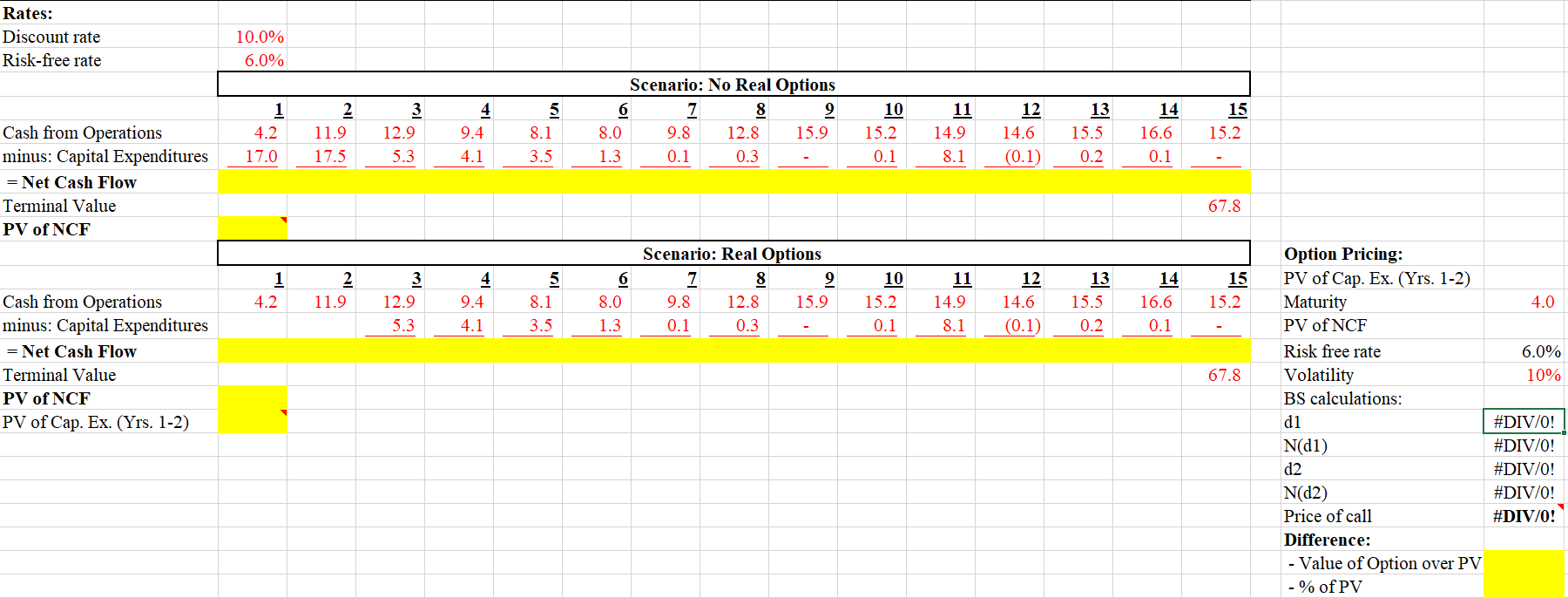

JTM Airlines, where you work, is looking at potentially buying more gates at their home airport. If it pays the airport $1M, JTM will hold exclusive rights to buy those gates for $17M (at the start) and $17.5M (one year later) at any time in the next 4 years. The option expires at the end of year 4. JTM's discount rate is 10%. What is the NPV of the gate purchases if it bought them today? Use the data in the Excel template provided.

Rates: Discount rate Risk-free rate 10.0% 6.0% 4 15 1 4.2 17.0 2 11.9 17.5 3 12.9 5.3 Scenario: No Real Options 6 7 8 2 8.0 9.8 12.8 15.9 1.3 0.1 0.3 5 8.1 3.5 9.4 10 15.2 0.1 11 14.9 8.1 12 14.6 (0.1) 13 15.5 0.2 14 16.6 0.1 15.2 4.1 Cash from Operations minus: Capital Expenditures = Net Cash Flow Terminal Value PV of NCF 67.8 1 4.2 2 11.9 3 12.9 5.3 4 9.4 4.1 5 8.1 3.5 6 8.0 1.3 Scenario: Real Options 7 8 9 9.8 12.8 15.9 0.1 0.3 10 15.2 0.1 11 14.9 8.1 12 14.6 (0.1) 13 15.5 0.2 14 16.6 0.1 15 15.2 4.0 Cash from Operations minus: Capital Expenditures = Net Cash Flow Terminal Value PV of NCF PV of Cap. Ex. (Yrs. 1-2) 6.0% 10% 67.8 Option Pricing: PV of Cap. Ex. (Yrs. 1-2) Maturity PV of NCF Risk free rate Volatility BS calculations: di N(1) d2 N(02) Price of call Difference: - Value of Option over PV - % of PV #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts