Question: Please include excel formulas, thank you. 9. Cakculating Project OCF [GS LO1] Esfandairi Enterprises is considering a new three-year expansion project that requires an initial

![Please include excel formulas, thank you. 9. Cakculating Project OCF [GS LO1]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670256c3363ed_530670256c2cc288.jpg)

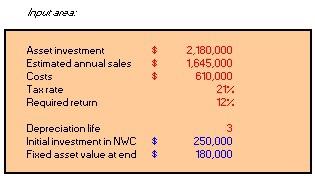

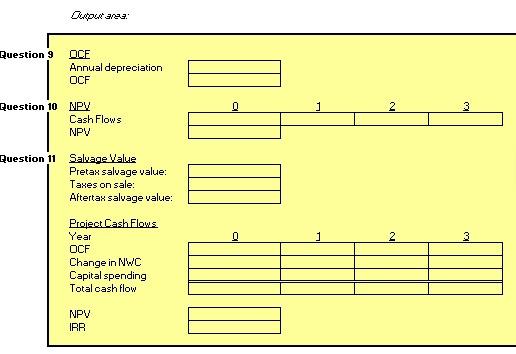

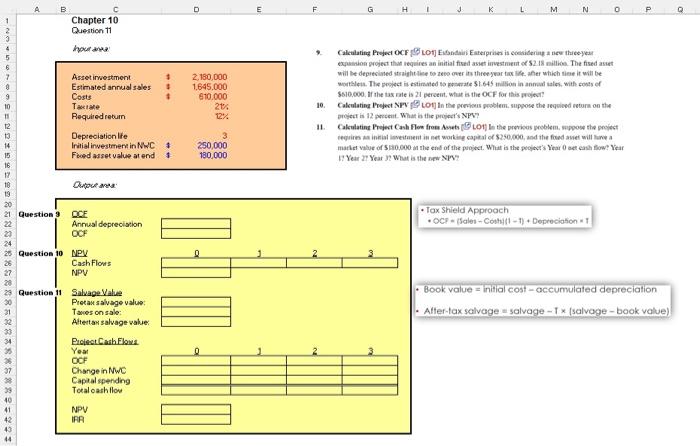

9. Cakculating Project OCF [GS LO1] Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 mitlion. The fixed asset aill be depreciated straight line to zero over its threeyear tax life, after which time it will be worthless. The project is estimated to generate $1.645 mitlion in annual sales, with costs of $610,000. If the tax rate is 21 percent, what is the OCF for this project? 10. Calculatimg Project NPV [S LO1] In the previous problem. suppose the reguired return on the project is 12 percent. What is the project's NPV? 11. Calculating Project Cash Flow from Assets [[S) LO1] In the previous problem. suppose the project requires an initial investment in net working capital of $250,000, and the fixed asset will have a market value of $180,000 at the end of the project. What is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? What is the new NPV? hoor 3nes: , pow sos: DCE Annual depreciation DCF Question 10 NPW CashFlows NPV \begin{tabular}{|l|l|l|l|} \hline 0 & 1 & 2 & 3 \\ \hline & & & \\ \hline & & & \end{tabular} Question 11 SaluageValue Pretan salvage value: Tares on sale: Aftertan saluage value: \begin{tabular}{|l|} \hline \\ \hline \\ \hline \end{tabular} Project CashFlows Year DCF Change in N 'C Capital spending Total cash flow \begin{tabular}{|l|l|l|l|} \hline \multicolumn{0}{c}{} & \multicolumn{2}{c}{3} & 3 \\ \hline & & & \\ \hline & & & \\ \hline \hline & & & \\ \hline & & & \\ \hline \end{tabular} NPU IRR \begin{tabular}{|} \hline \\ \hline \end{tabular} expusion groject that requires an initial fised asse imvestment of 5. I nillion. The fised aset project is 12 peceeut. What is the pruject's NPW? 11. Cakulatint Project Cavh flew free Avets (B LO1) in the provious problem, wpoose tha proidet marker value of 5 sio.000 an the end of the puoject. What is the poolect's Vear 0 aet eash bow? Vear 1? Year d? Year 32 Whar is the sew NPY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts