Question: Please include excel formulas You decide to buy a new house. The house price is $400,000. You have two payment plans. 1) Make a 5%

Please include excel formulas

Please include excel formulas

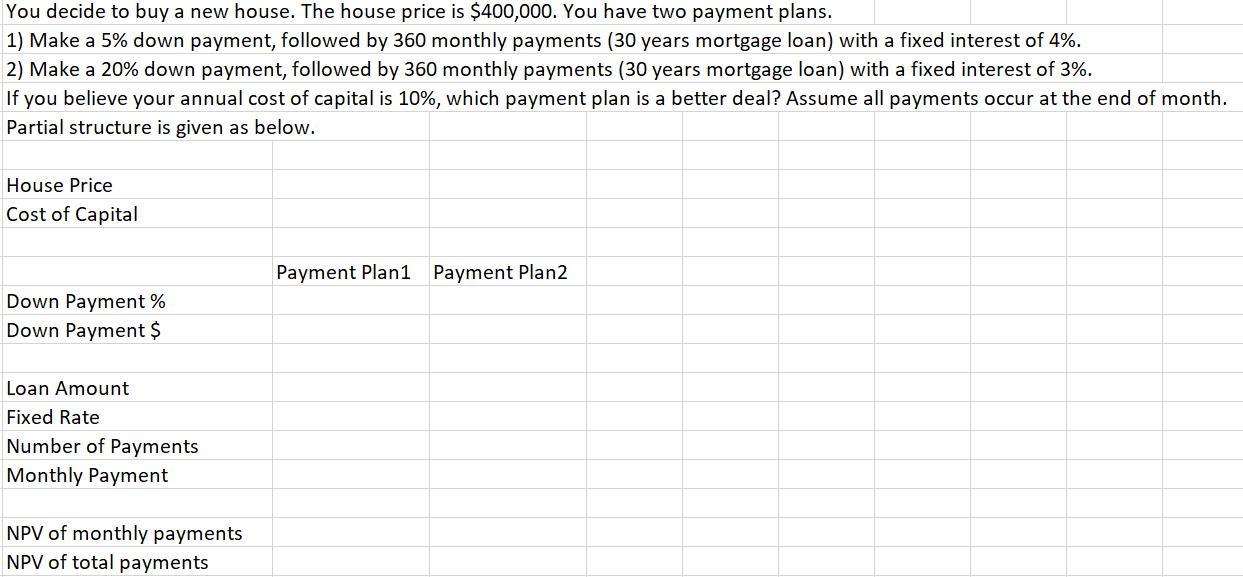

You decide to buy a new house. The house price is $400,000. You have two payment plans. 1) Make a 5% down payment, followed by 360 monthly payments (30 years mortgage loan) with a fixed interest of 4%. 2) Make a 20% down payment, followed by 360 monthly payments (30 years mortgage loan) with a fixed interest of 3%. If you believe your annual cost of capital is 10%, which payment plan is a better deal? Assume all payments occur at the end of month. Partial structure is given as below. House Price Cost of Capital Payment Plant Payment Plan2 Down Payment % Down Payment $ Loan Amount Fixed Rate Number of Payments Monthly Payment NPV of monthly payments NPV of total payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts