Question: please include Explanations. Max and Bob planning to open a food service operation and have heard about operating leverage. They are forecasting annual sales and

please include Explanations.

please include Explanations.

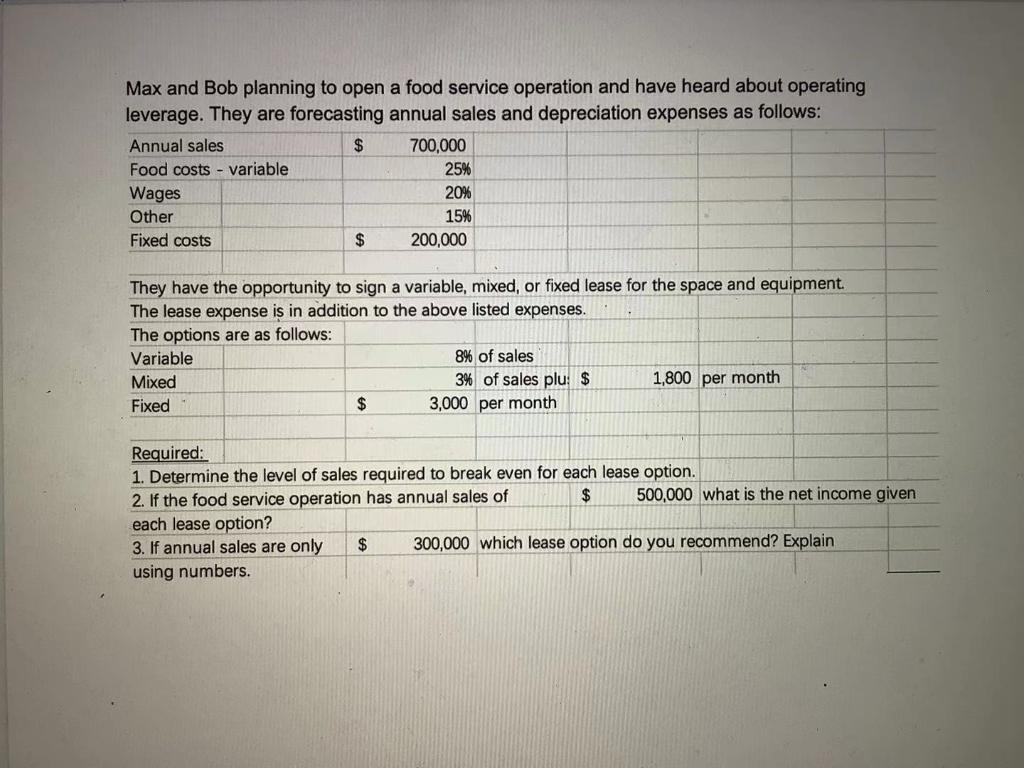

Max and Bob planning to open a food service operation and have heard about operating leverage. They are forecasting annual sales and depreciation expenses as follows: Annual sales $ 700,000 Food costs - variable 25% Wages 20% Other 15% Fixed costs $ 200,000 They have the opportunity to sign a variable, mixed, or fixed lease for the space and equipment. The lease expense is in addition to the above listed expenses. The options are as follows: Variable 8% of sales Mixed 3% of sales plu: $ 1,800 per month Fixed $ 3,000 per month Required: 1. Determine the level of sales required to break even for each lease option. 2. If the food service operation has annual sales of $ 500,000 what is the net income given each lease option? 3. If annual sales are only $ 300,000 which lease option do you recommend? Explain using numbers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts