Question: Please include explanations, thank you! E6.8 Davis Enterprises, Inc. has a December 31 year end. On January 11, 20X4, Davis Enterprises, Inc. purchased a truck

Please include explanations, thank you!

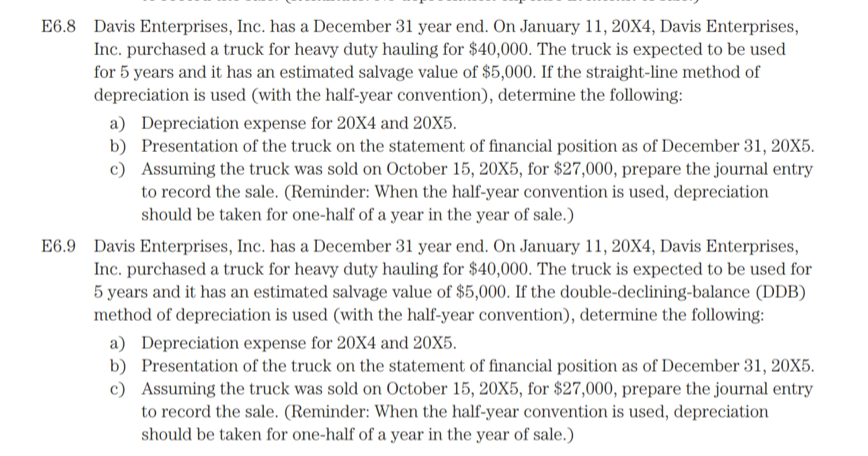

E6.8 Davis Enterprises, Inc. has a December 31 year end. On January 11, 20X4, Davis Enterprises, Inc. purchased a truck for heavy duty hauling for $40,000. The truck is expected to be used for 5 years and it has an estimated salvage value of $5,000. If the straight-line method of depreciation is used (with the half-year convention), determine the following: a) Depreciation expense for 20X4 and 20X5. b) Presentation of the truck on the statement of financial position as of December 31, 20X5. c) Assuming the truck was sold on October 15, 20X5, for $27,000, prepare the journal entry to record the sale. (Reminder: When the half-year convention is used, depreciation should be taken for one-half of a year in the year of sale.) E6.9 Davis Enterprises, Inc. has a December 31 year end. On January 11, 20X4, Davis Enterprises, Inc. purchased a truck for heavy duty hauling for $40,000. The truck is expected to be used for 5 years and it has an estimated salvage value of $5,000. If the double-declining-balance (DDB) method of depreciation is used (with the half-year convention), determine the following: a) Depreciation expense for 20X4 and 20X5. b) Presentation of the truck on the statement of financial position as of December 31, 20X5. c) Assuming the truck was sold on October 15, 20X5, for $27,000, prepare the journal entry to record the sale. (Reminder: When the half-year convention is used, depreciation should be taken for one-half of a year in the year of sale.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts