Question: Please include formula and working. thank you Problem 2 (4 marks) You have been offered a settlement from a court case. You options are as

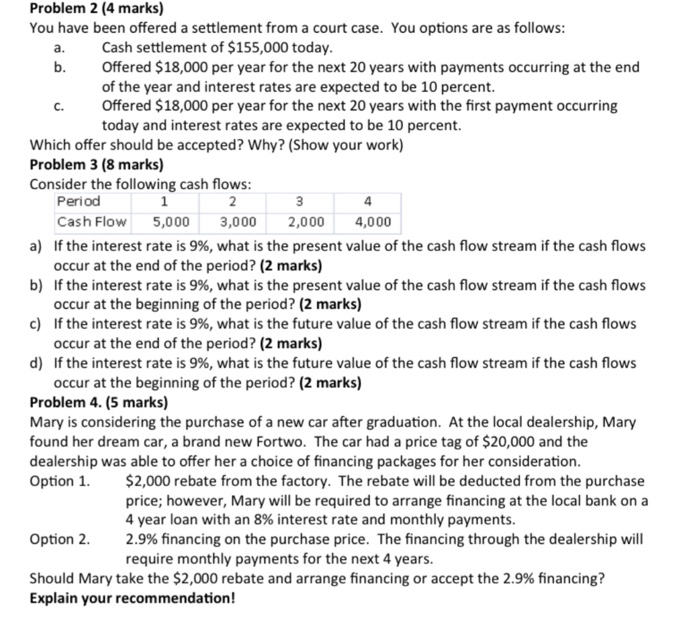

Problem 2 (4 marks) You have been offered a settlement from a court case. You options are as follows: a. Cash settlement of $155,000 today. b. Offered $18,000 per year for the next 20 years with payments occurring at the end of the year and interest rates are expected to be 10 percent. Offered $18,000 per year for the next 20 years with the first payment occurring today and interest rates are expected to be 10 percent. Which offer should be accepted? Why? (Show your work) Problem 3 (8 marks) Consider the following cash flows: Period 1 2 3 4 Cash Flow 5,000 3,000 2,000 4,000 a) If the interest rate is 9%, what is the present value of the cash flow stream if the cash flows occur at the end of the period? (2 marks) b) If the interest rate is 9%, what is the present value of the cash flow stream if the cash flows occur at the beginning of the period? (2 marks) c) If the interest rate is 9%, what is the future value of the cash flow stream if the cash flows occur at the end of the period? (2 marks) d) If the interest rate is 9%, what is the future value of the cash flow stream if the cash flows occur at the beginning of the period? (2 marks) Problem 4. (5 marks) Mary is considering the purchase of a new car after graduation. At the local dealership, Mary found her dream car, a brand new Fortwo. The car had a price tag of $20,000 and the dealership was able to offer her a choice of financing packages for her consideration. Option 1. $2,000 rebate from the factory. The rebate will be deducted from the purchase price; however, Mary will be required to arrange financing at the local bank on a 4 year loan with an 8% interest rate and monthly payments. Option 2. 2.9% financing on the purchase price. The financing through the dealership will require monthly payments for the next 4 years. Should Mary take the $2,000 rebate and arrange financing or accept the 2.9% financing? Explain your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts