Question: Please include formulas and one example of the numbers that fit with the formula The beta of a portfolio is simply a weighted average of

Please include formulas and one example of the numbers that fit with the formula

Please include formulas and one example of the numbers that fit with the formula

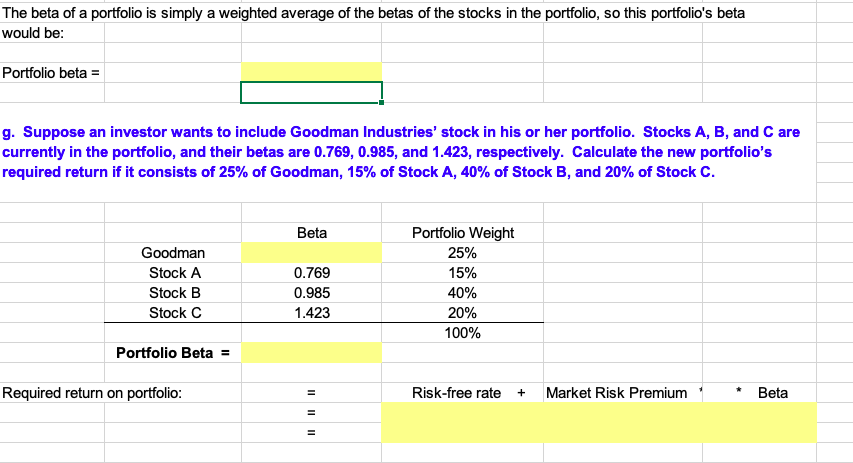

The beta of a portfolio is simply a weighted average of the betas of the stocks in the portfolio, so this portfolio's beta would be: Portfolio beta = g. Suppose an investor wants to include Goodman Industries' stock in his or her portfolio. Stocks A, B, and Care currently in the portfolio, and their betas are 0.769, 0.985, and 1.423, respectively. Calculate the new portfolio's required return if it consists of 25% of Goodman, 15% of Stock A, 40% of Stock B, and 20% of Stock C. Beta Goodman Stock A Stock B Stock C 0.769 0.985 1.423 Portfolio Weight 25% 15% 40% 20% 100% Portfolio Beta = Required return on portfolio: Risk-free rate + Market Risk Premium Beta = = The beta of a portfolio is simply a weighted average of the betas of the stocks in the portfolio, so this portfolio's beta would be: Portfolio beta = g. Suppose an investor wants to include Goodman Industries' stock in his or her portfolio. Stocks A, B, and Care currently in the portfolio, and their betas are 0.769, 0.985, and 1.423, respectively. Calculate the new portfolio's required return if it consists of 25% of Goodman, 15% of Stock A, 40% of Stock B, and 20% of Stock C. Beta Goodman Stock A Stock B Stock C 0.769 0.985 1.423 Portfolio Weight 25% 15% 40% 20% 100% Portfolio Beta = Required return on portfolio: Risk-free rate + Market Risk Premium Beta = =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts