Question: Please include formulas and steps to find answer. Thank you! Extra Practice: Preferred Stock, $20 par, 10,000 shares$160,000 authorized, 8,000 shares issued and outstanding Common

Please include formulas and steps to find answer. Thank you!

Please include formulas and steps to find answer. Thank you!

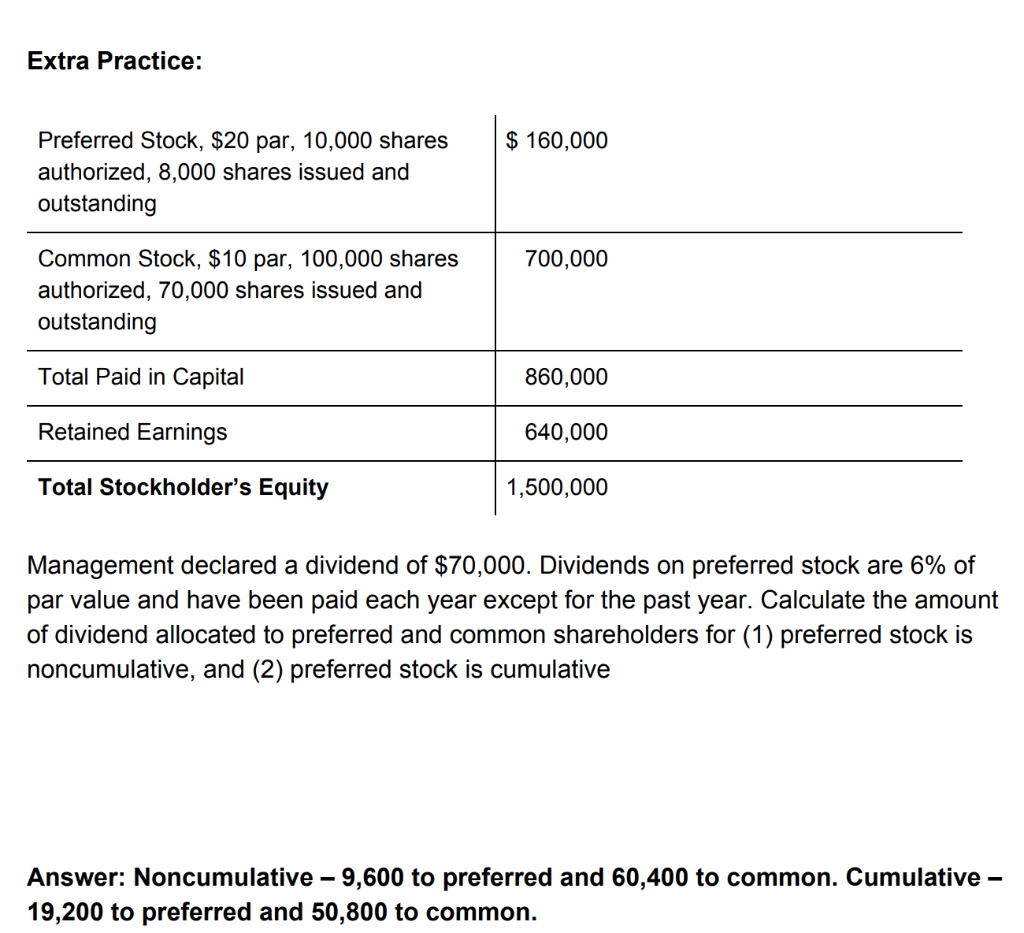

Extra Practice: Preferred Stock, $20 par, 10,000 shares$160,000 authorized, 8,000 shares issued and outstanding Common Stock, $10 par, 100,000 shares700,000 authorized, 70,000 shares issued and outstanding Total Paid in Capital Retained Earnings Total Stockholder's Equity 860,000 640,000 1,500,000 Management declared a dividend of $70,000. Dividends on preferred stock are 6% of par value and have been paid each year except for the past year. Calculate the amount of dividend allocated to preferred and common shareholders for (1) preferred stock is noncumulative, and (2) preferred stock is cumulative Answer: Noncumulative - 9,600 to preferred and 60,400 to common. Cumulative - 19,200 to preferred and 50,800 to common

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts