Question: PLEASE INCLUDE FORMULAS AND USE THE INCLUDED TEMPLATE FOR INSTANT UPVOTE b.Argo's maintenance service business grosses some $8M per year before discounts and its average

PLEASE INCLUDE FORMULAS AND USE THE INCLUDED TEMPLATE FOR INSTANT UPVOTE

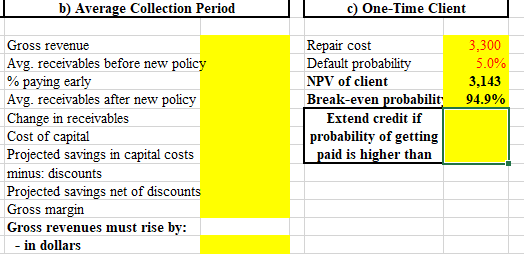

b.Argo's maintenance service business grosses some $8M per year before discounts and its average days receivable is 25 (unlike the overall business where this number is ~15). If 45% of Argo's clients opt to pay earlier and get the 0.5% discount, what will be the change in the service business's receivables? If Argo's cost of capital is 5.5%, what are the projected savings of this change in policy? If Argo's gross margin is 25%, by how much will gross dollar revenues have to rise to offset the loss from discounts? In percent?

c.A new client from out of town is quoted $3,300 for a repair. The service people ask you to approve this. You do a quick check on the client and assess a 5% default risk. What is the NPV of the client? What is the break-even probability? What is the minimum probability of collecting for you to approve the service

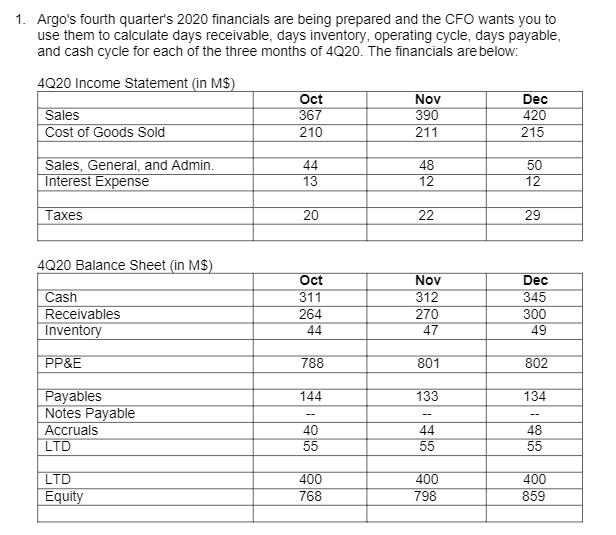

1. Argo's fourth quarter's 2020 financials are being prepared and the CFO wants you to use them to calculate days receivable, days inventory, operating cycle, days payable, and cash cycle for each of the three months of 4Q20. The financials are below: 4Q20 Income Statement in M$) Sales Cost of Goods Sold Oct 367 210 Nov 390 211 Dec 420 215 Sales, General, and Admin. Interest Expense 44 13 48 12 50 12 Taxes 20 22 29 4020 Balance Sheet (in M$) Cash Receivables Inventory Oct 311 264 44 Nov 312 270 47 Dec 345 300 49 PP&E 788 801 802 144 133 134 Payables Notes Payable Accruals LTD 40 55 44 48 55 55 LTD Equity 400 768 400 798 400 859 b) Average Collection Period c) One-Time Client Gross revenue Avg. receivables before new policy % paying early Avg. receivables after new policy Change in receivables Cost of capital Projected savings in capital costs minus: discounts Projected savings net of discounts Gross margin Gross revenues must rise by: - in dollars Repair cost Default probability NPV of client Break-even probabilit Extend credit if probability of getting paid is higher than 3,300 5.0% 3,143 94.9% 1. Argo's fourth quarter's 2020 financials are being prepared and the CFO wants you to use them to calculate days receivable, days inventory, operating cycle, days payable, and cash cycle for each of the three months of 4Q20. The financials are below: 4Q20 Income Statement in M$) Sales Cost of Goods Sold Oct 367 210 Nov 390 211 Dec 420 215 Sales, General, and Admin. Interest Expense 44 13 48 12 50 12 Taxes 20 22 29 4020 Balance Sheet (in M$) Cash Receivables Inventory Oct 311 264 44 Nov 312 270 47 Dec 345 300 49 PP&E 788 801 802 144 133 134 Payables Notes Payable Accruals LTD 40 55 44 48 55 55 LTD Equity 400 768 400 798 400 859 b) Average Collection Period c) One-Time Client Gross revenue Avg. receivables before new policy % paying early Avg. receivables after new policy Change in receivables Cost of capital Projected savings in capital costs minus: discounts Projected savings net of discounts Gross margin Gross revenues must rise by: - in dollars Repair cost Default probability NPV of client Break-even probabilit Extend credit if probability of getting paid is higher than 3,300 5.0% 3,143 94.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts