Question: Please include formulas B D Problem 8-9 Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate,

Please include formulas

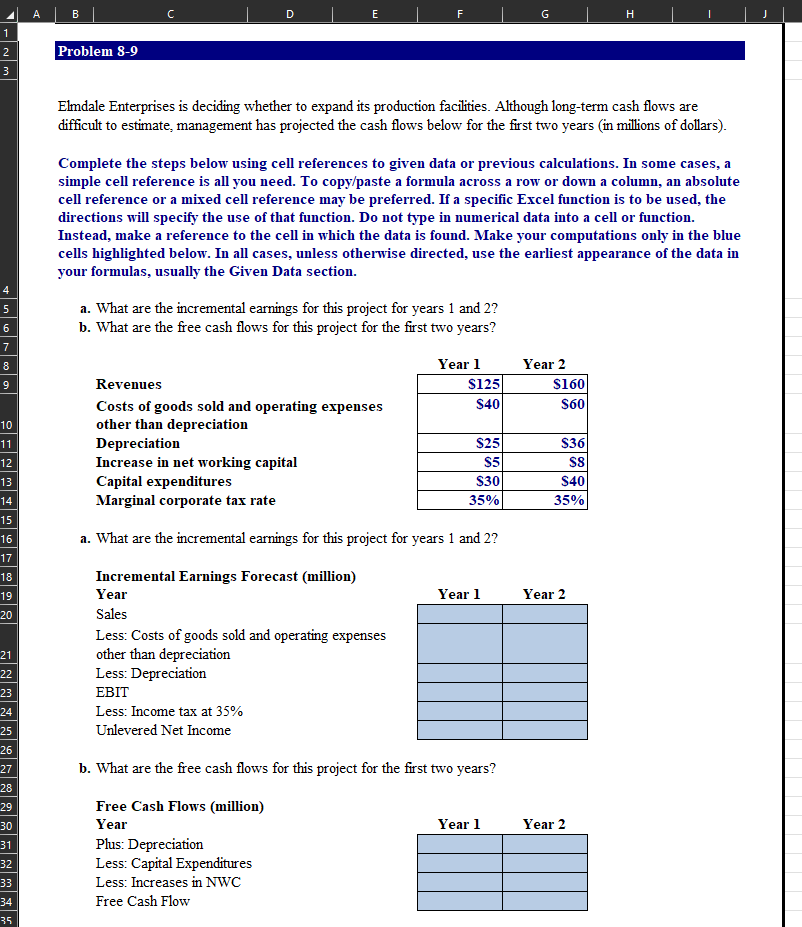

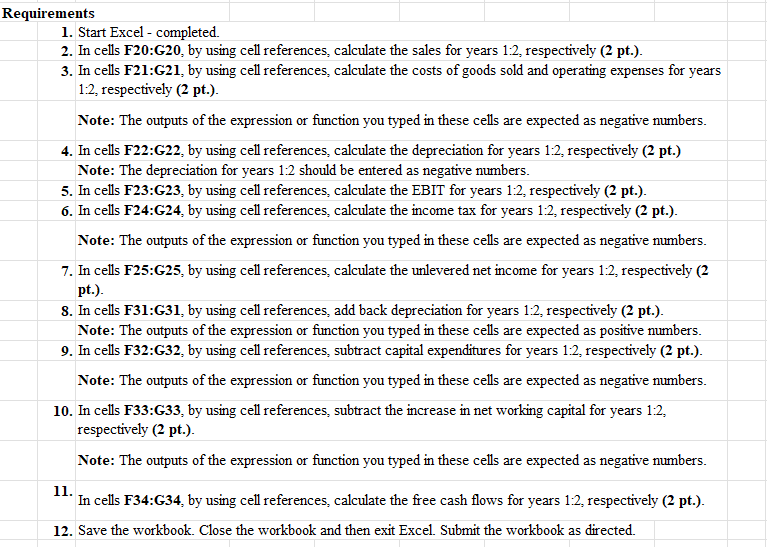

B D Problem 8-9 Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the cash flows below for the first two years (in millions of dollars). Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. What are the incremental earnings for this project for years 1 and 2? b. What are the free cash flows for this project for the first two years? Year 1 Year 2 Revenues $125 $160 Costs of goods sold and operating expenses $40 $60 other than depreciation Depreciation $25 $36 Increase in net working capital $5 Capital expenditures $30 $40 Marginal corporate tax rate 35% 35% a. What are the incremental earnings for this project for years 1 and 2? Incremental Earnings Forecast (million) Year Year 1 Year 2 Sales Less: Costs of goods sold and operating expenses other than depreciation Less: Depreciation EBIT Less: Income tax at 35% Unlevered Net Income b. What are the free cash flows for this project for the first two years? Free Cash Flows (million) Year Year 1 Year 2 Plus: Depreciation Less: Capital Expenditures Less: Increases in NWC Free Cash FlowRequirements 1 2 3 10. 11 12 . Start Excel completed. . In cells FZDGZD, by using cell references calculate the sales for years 12, respectively [2 pt}. . In cells F21:G21, by using cell references calculate the costs of goods sold and operating expenses for years 12, respectively [2 pt}. Note: The outputs of the expression or function you typed in these cells are expected as negative numbers. In cells F22:G22, by using cell references calculate the depreciation for years 11 respectively [2 pt.) Note: The depreciation for years 12 should be entered as negative numbers. In cells F23:G23, by using cell references calculate the EBIT for years 11 respectively [2 pt}. In cells F24:G24, by using cell references calculate the income tax for years 11 respectively [2 pt}. Note: The outputs of the expression or function you typed in these cells are expected as negative numbers. In cells F25:G25, by using cell references calculate the unlevered net income for years 11 respectively [2 pt}. In cells F31:G31, by using cell references add back depreciation for years 11 respectively [2 pt}. Note: The outputs of the expression or function you typed in these cells are expected as positive numbers. In cells 1323332, by using cell references subtract capital expenditures for years 11 respectively [2 pt}. Note: The outputs of the expression or function you typed in these cells are expected as negative numbers. In cells 1333333, by using cell references subtract the increase in net working capital for years 11 respectively [2 pt}. Note: The outputs of the expression or function you typed in these cells are expected as negative numbers. ' In cells 1343334, by using cell references calculate the ee cash ows for years 131 respectively [2 pt}. . Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts