Question: Please include formulas for highlighted cells You are contemplating about whether to use book value or market value weights in WACC calculation. Your firm's balance

Please include formulas for highlighted cells

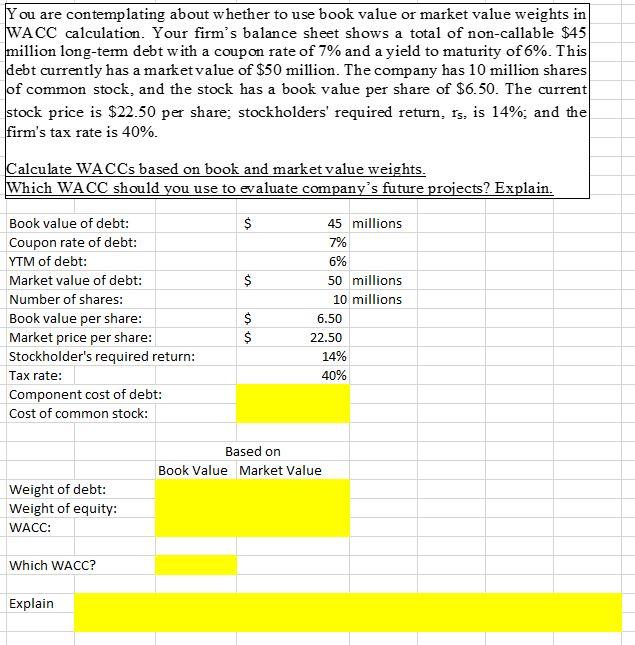

You are contemplating about whether to use book value or market value weights in WACC calculation. Your firm's balance sheet shows a total of non-callable $45 million long-term debt with a coupon rate of 7% and a yield to maturity of 6%. This debt currently has a market value of $50 million. The company has 10 million shares of common stock, and the stock has a book value per share of $6.50. The current stock price is $22.50 per share: stockholders' required return, is, is 14%, and the firm's tax rate is 40%. Calculate WACCs based on book and market value weights. Which WACC should you use to evaluate company's future projects? Explain. $ $ Book value of debt: Coupon rate of debt: YTM of debt: Market value of debt: Number of shares: Book value per share: Market price per share: Stockholder's required return: Tax rate: Component cost of debt: Cost of common stock: 45 millions 7% 6% 50 millions 10 millions 6.50 22.50 14% 40% $ $ Based on Book Value Market Value Weight of debt: Weight of equity: WACC: Which WACC? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts