Question: Please include formulas if possible. I have included the Assumptions with the numbers and percentages as well as the the complete Project Income Statement. PLEASE

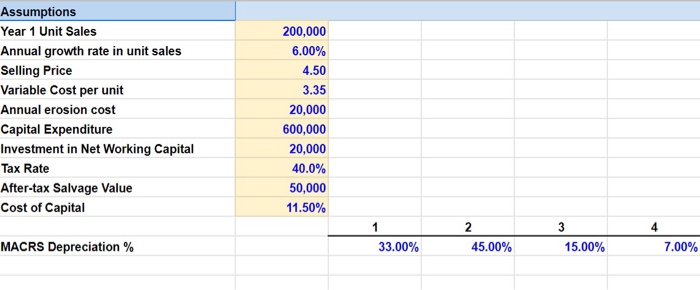

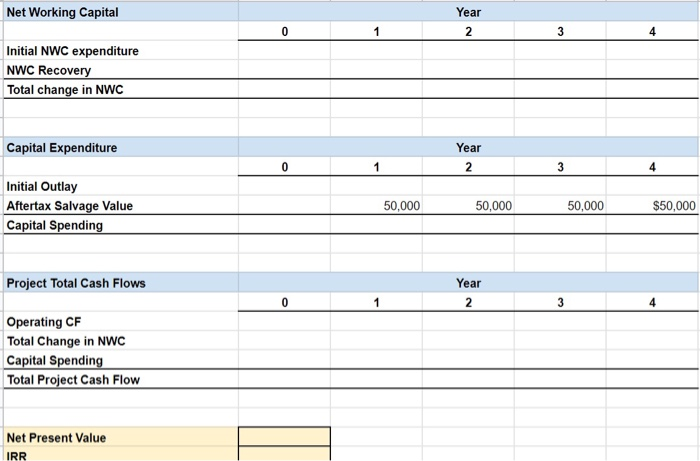

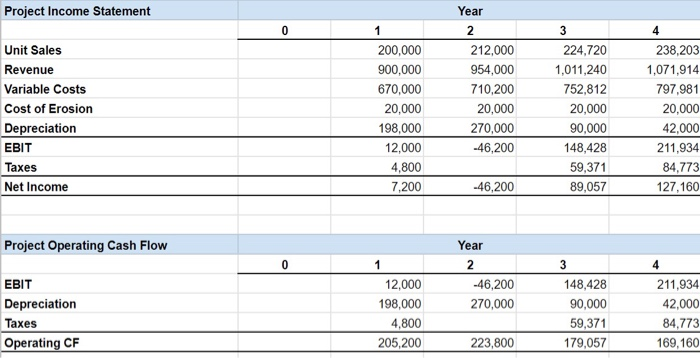

Assumptions Year 1 Unit Sales Annual growth rate in unit sales Selling Price Variable Cost per unit Annual erosion cost Capital Expenditure Investment in Net Working Capital Tax Rate After-tax Salvage Value Cost of Capital 200,000 6.00% 4.50 3.35 20,000 600,000 20,000 40.0% 50,000 11.50% MACRS Depreciation % 45.00% 5.00% * 7.00% 33.00% 45.00% 15.00% Net Working Capital Year 2 Initial NWC expenditure NWC Recovery Total change in NWC Capital Expenditure 1 Year 2 3 Initial Outlay Aftertax Salvage Value Capital Spending 50,000 50,000 50,000 $50,000 Project Total Cash Flows 0 1 Year 2 3 Operating CF Total Change in NWC Capital Spending Total Project Cash Flow Net Present Value IRR Project Income Statement Year 0 4 Unit Sales Revenue Variable Costs Cost of Erosion Depreciation EBIT Taxes Net Income 200,000 900,000 670,000 20,000 198,000 12,000 4,800 7,200 212,000 954,000 710,200 20,000 270,000 -46,200 3 224,720 1,011,240 752,812 20,000 90.000 148,428 59,371 89,057 238,203 1,071,914 797,981 20,000 42,000 211,934 84.773 127,160 -46,200 Project Operating Cash Flow Year -46,200 270,000 EBIT Depreciation Taxes Operating CF 12,000 198,000 4,800 205,200 148,428 90,000 59,371 179,057 211,934 42,000 84,773 169,160 223,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts