Question: PLEASE INCLUDE FORMULAS! THANK YOU! Argo Airlines, a privately held firm, is looking to buy additional gates at its home airport for $350,000. Argo has

PLEASE INCLUDE FORMULAS! THANK YOU!

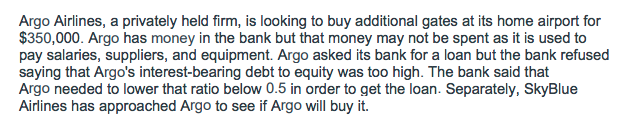

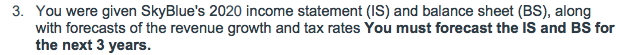

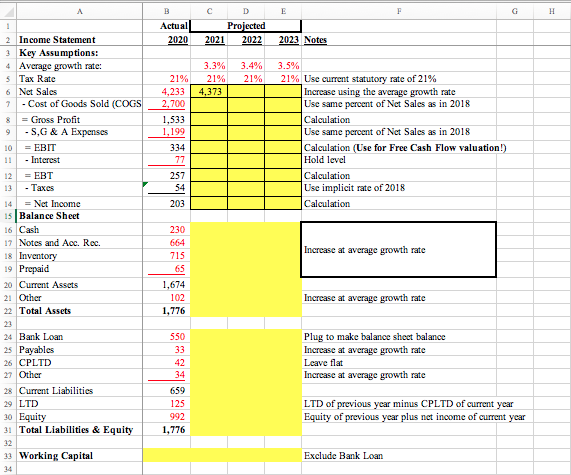

Argo Airlines, a privately held firm, is looking to buy additional gates at its home airport for $350,000. Argo has money in the bank but that money may not be spent as it is used to pay salaries, suppliers, and equipment. Argo asked its bank for a loan but the bank refused saying that Argo's interest-bearing debt to equity was too high. The bank said that Argo needed to lower that ratio below 0.5 in order to get the loan. Separately, SkyBlue Airlines has approached Argo to see if Argo will buy it. 3. You were given SkyBlue's 2020 income statement (IS) and balance sheet (BS), along with forecasts of the revenue growth and tax rates You must forecast the IS and BS for the next 3 years. B E F G H Actual 2020 D Projected 2021 2022 2023 Notes 3.3% 21% 4,373 3.4% 21% 21% 4,233 2.700 1,533 1,199 1 2 Income Statement 3 Key Assumptions: 4 Average growth rate: 5 Tax Rate 6 Net Sales 7 - Cost of Goods Sold (COGS 8 = Gross Profit -S,G & A Expenses 10 = EBIT - Interest 12 = EBT - Taxes 14 = Net Income 15 Balance Sheet 16 Cash 17 Notes and Acc. Rec. 18 Inventory 19 Prepaid 20 Current Assets 21 Other 22 Total Assets 3.5% 21% Use current statutory rate of 21% Increase using the average growth rate Use same percent of Net Sales as in 2018 Calculation Use same percent of Net Sales as in 2018 Calculation (Use for Free Cash Flow valuation!) Hold level Calculation Use implicit rate of 2018 Calculation 334 77 257 54 203 Increase at average growth rate 230 664 715 65 1,674 102 1,776 Increase at average growth rate Plug to make balance sheet balance Increase at average growth rate Leave flat Increase at average growth rate 24 Bank Loan 25 Payables 26 CPLTD 27 Other 28 Current Liabilities 29 LTD 30 Equity 31 Total Liabilities & Equity 32 13 Working Capital 550 33 42 34 659 125 992 1,776 LTD of previous year minus CPLTD of current year Equity of previous year plus net income of current year Exclude Bank Loan Argo Airlines, a privately held firm, is looking to buy additional gates at its home airport for $350,000. Argo has money in the bank but that money may not be spent as it is used to pay salaries, suppliers, and equipment. Argo asked its bank for a loan but the bank refused saying that Argo's interest-bearing debt to equity was too high. The bank said that Argo needed to lower that ratio below 0.5 in order to get the loan. Separately, SkyBlue Airlines has approached Argo to see if Argo will buy it. 3. You were given SkyBlue's 2020 income statement (IS) and balance sheet (BS), along with forecasts of the revenue growth and tax rates You must forecast the IS and BS for the next 3 years. B E F G H Actual 2020 D Projected 2021 2022 2023 Notes 3.3% 21% 4,373 3.4% 21% 21% 4,233 2.700 1,533 1,199 1 2 Income Statement 3 Key Assumptions: 4 Average growth rate: 5 Tax Rate 6 Net Sales 7 - Cost of Goods Sold (COGS 8 = Gross Profit -S,G & A Expenses 10 = EBIT - Interest 12 = EBT - Taxes 14 = Net Income 15 Balance Sheet 16 Cash 17 Notes and Acc. Rec. 18 Inventory 19 Prepaid 20 Current Assets 21 Other 22 Total Assets 3.5% 21% Use current statutory rate of 21% Increase using the average growth rate Use same percent of Net Sales as in 2018 Calculation Use same percent of Net Sales as in 2018 Calculation (Use for Free Cash Flow valuation!) Hold level Calculation Use implicit rate of 2018 Calculation 334 77 257 54 203 Increase at average growth rate 230 664 715 65 1,674 102 1,776 Increase at average growth rate Plug to make balance sheet balance Increase at average growth rate Leave flat Increase at average growth rate 24 Bank Loan 25 Payables 26 CPLTD 27 Other 28 Current Liabilities 29 LTD 30 Equity 31 Total Liabilities & Equity 32 13 Working Capital 550 33 42 34 659 125 992 1,776 LTD of previous year minus CPLTD of current year Equity of previous year plus net income of current year Exclude Bank Loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts