Question: Please include formulas. Thank you! Problem 1 a. Find the value of the property today based on 7 years of net operating income and a

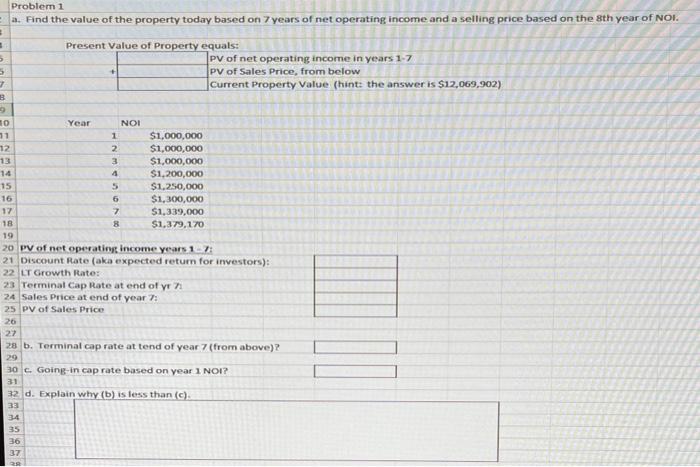

Problem 1 a. Find the value of the property today based on 7 years of net operating income and a selling price based on the 8th year of Nol. Present Value of Property equals: \begin{tabular}{|l|l} \hline & PV of net operating income in years 17 \\ PV of Sales Price, from below \\ Current Property Value (hint: the answer is $12,069,902 ) \end{tabular} Year 12345678NOI$1,000,000$1,000,000$1,000,000$1,200,000$1,250,000$1,300,000$1,339,000$1,379,170 PV of net operating income years 17: Discount Rate (aka expected return for investors): LT Growth Rate: Terminal Cap Rate at end of yr 7 Sales Price at end of year 7 : pV of Sales Price b. Terminal cap rate at tend of year 7 (from above)? c. Going-in cap rate based on year 1 NOI? d. Explain why (b) is less than (c). Problem 1 a. Find the value of the property today based on 7 years of net operating income and a selling price based on the 8th year of Nol. Present Value of Property equals: \begin{tabular}{|l|l} \hline & PV of net operating income in years 17 \\ PV of Sales Price, from below \\ Current Property Value (hint: the answer is $12,069,902 ) \end{tabular} Year 12345678NOI$1,000,000$1,000,000$1,000,000$1,200,000$1,250,000$1,300,000$1,339,000$1,379,170 PV of net operating income years 17: Discount Rate (aka expected return for investors): LT Growth Rate: Terminal Cap Rate at end of yr 7 Sales Price at end of year 7 : pV of Sales Price b. Terminal cap rate at tend of year 7 (from above)? c. Going-in cap rate based on year 1 NOI? d. Explain why (b) is less than (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts