Question: Please include formulas used and if you can do at least one example and line up the correct numbers to the formula it would be

Please include formulas used and if you can do at least one example and line up the correct numbers to the formula it would be appreciated. I am trying to learn this and it is just very confusing.

Please include formulas used and if you can do at least one example and line up the correct numbers to the formula it would be appreciated. I am trying to learn this and it is just very confusing.

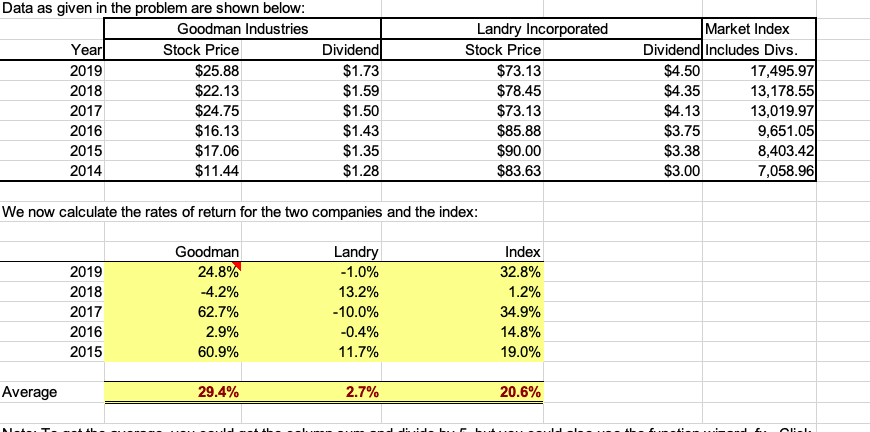

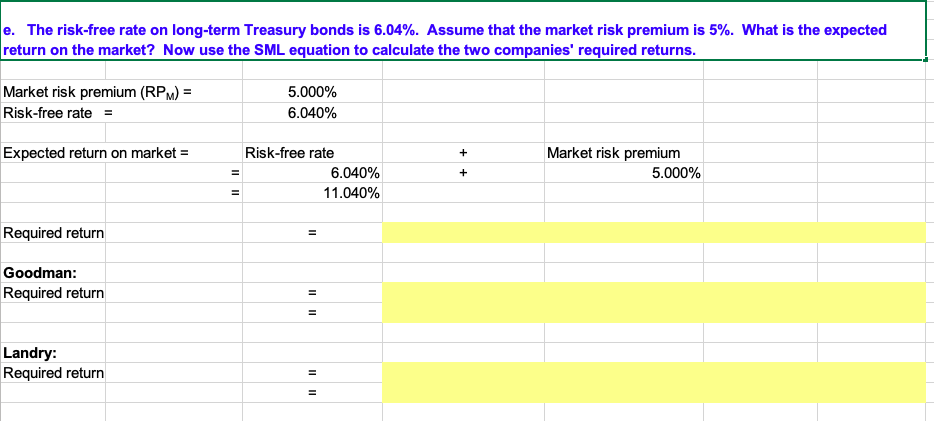

Data as given in the problem are shown below: Goodman Industries Year Stock Price 2019 $25.88 2018 $22.13 2017 $24.75 2016 $16.13 2015 $17.06 2014 $11.44 Dividend $1.73 $1.59 $1.50 $1.43 $1.35 $1.28 Landry Incorporated Stock Price $73.13 $78.45 $73.13 $85.88 $90.00 $83.63 Market Index Dividend Includes Divs. $4.50 17,495.97 $4.35 13,178.55 $4.13 13,019.97 $3.75 9,651.05 $3.38 8,403.42 $3.00 7,058.96 We now calculate the rates of return for the two companies and the index: 2019 2018 2017 2016 2015 Goodman 24.8% -4.2% 62.7% 2.9% 60.9% Landry -1.0% 13.2% -10.0% -0.4% 11.7% Index 32.8% 1.2% 34.9% 14.8% 19.0% Average 29.4% 2.7% 20.6% Cli e. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that the market risk premium is 5%. What is the expected return on the market? Now use the SML equation to calculate the two companies' required returns. Market risk premium (RPM) = Risk-free rate = 5.000% 6.040% Expected return on market = + Risk-free rate 6.040% 11.040% Market risk premium 5.000% + Il 11 Required return = Goodman: Required return = = Landry: Required return = =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts