Question: ***please include how you calculated all numbers Suppose the rate of return of Stock X over the next year depends on the state of the

***please include how you calculated all numbers

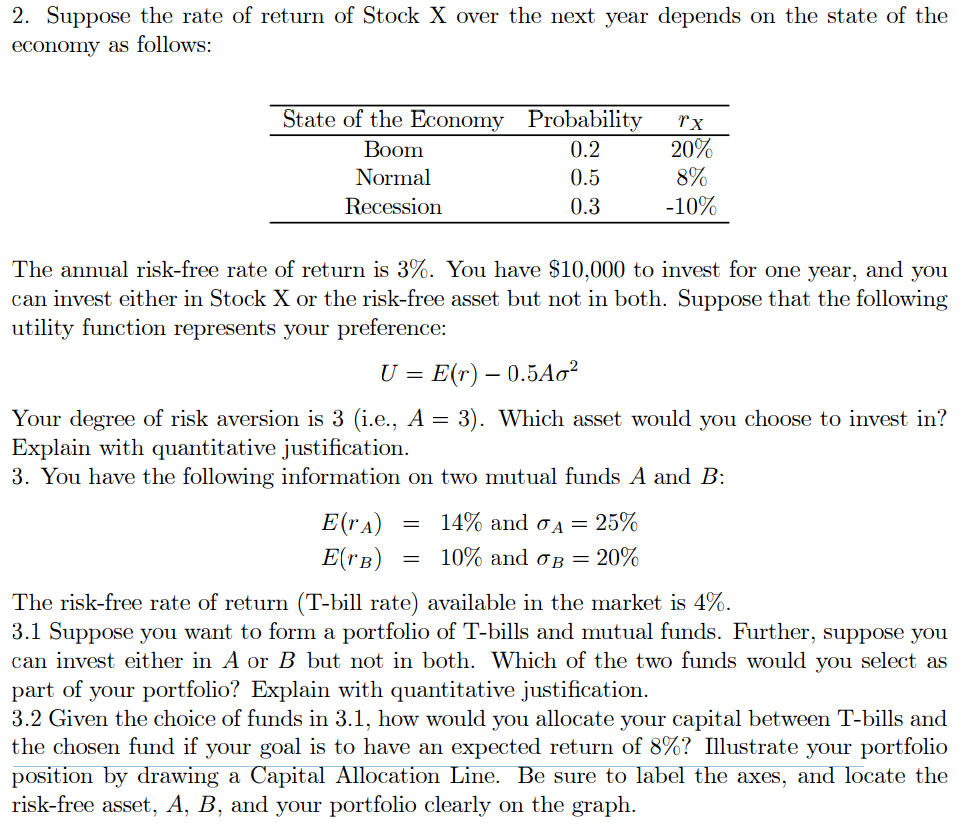

Suppose the rate of return of Stock X over the next year depends on the state of the economy as follows: The annual risk-free rate of return is 3%. You have $10,000 to invest for one year, and you can invest either in Stock X or the risk-free asset but not in both. Suppose that the following utility function represents your preference: U = E(r) - O.5Asigma^2 Your degree of risk aversion is 3 (i.e., A = 3). Which asset would you choose to invest in? Explain with quantitative justification. You have the following information on two mutual funds A and D: E(rA) = 14% and sigmaA = 25% E(rB) = 10% and sigmaB= 20% The risk-free rate of return (T-bill rate) available in the market is 4%. Suppose you want to form a portfolio of T-bills and mutual funds. Further, suppose you can invest either in A or D but not in both. Which of the two funds would you select as part of your portfolio? Explain with quantitative justification. Given the choice of funds in 3.1, how would you allocate your capital between T-bills and the chosen fund if your goal is to have an expected return of 8%? Illustrate your portfolio position by drawing a Capital Allocation Line. Be sure to label the axes, and locate the risk-free asset, A, D, and your portfolio clearly on the graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts