Question: Please include how you found the answer, specifically how to find the Market per Unit. Foster Factories, Inc. manufactures low-cost furniture. The company produces three

Please include how you found the answer, specifically how to find the Market per Unit.

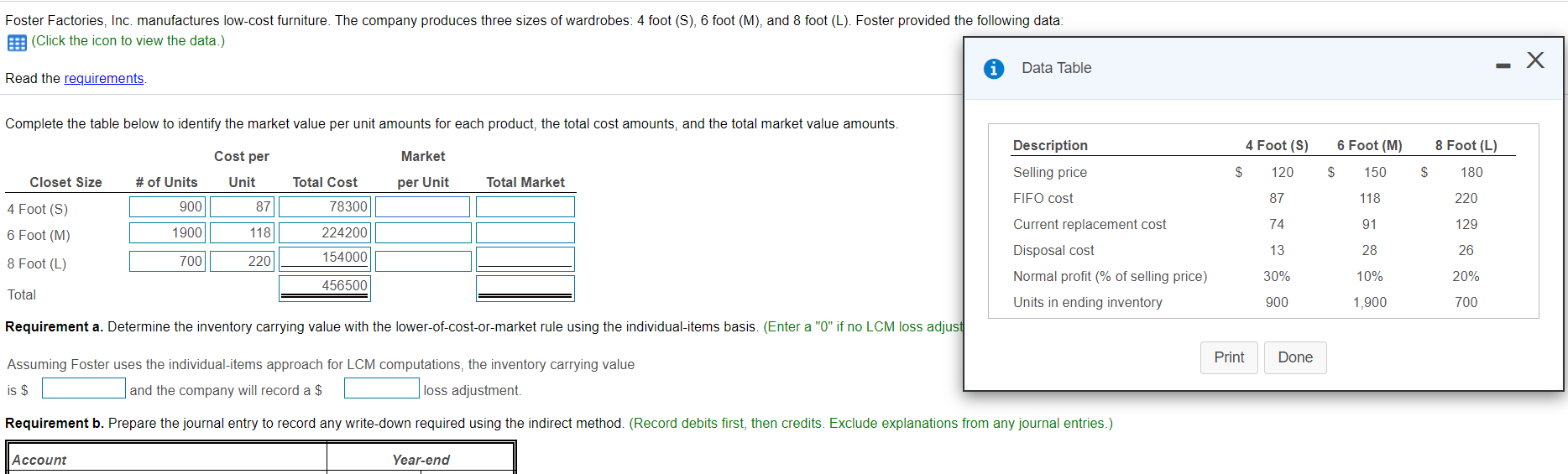

Foster Factories, Inc. manufactures low-cost furniture. The company produces three sizes of wardrobes: 4 foot (S), 6 foot (M), and 8 foot (L). Foster provided the following data: (Click the icon to view the data.) Data Table Read the requirements Complete the table below to identify the market value per unit amounts for each product, the total cost amounts, and the total market value amounts. Description 4 Foot (S) 6 Foot (M) 8 Foot (L) Cost per Market $ 120 $ 150 $ 180 Closet Size Unit Total Cost per Unit Total Market # of Units 900 Selling price FIFO cost 87 118 220 4 Foot (S) 87 78300 74 91 129 6 Foot (M) 1900 118 224200 13 28 26 8 Foot (L) 700 220 154000 Current replacement cost Disposal cost Normal profit % of selling price) Units in ending inventory 30% 10% 20% 456500 Total 900 1,900 700 Requirement a. Determine the inventory carrying value with the lower-of-cost-or- market rule using the individual-items basis. (Enter a "0" if no LCM loss adjust Print Done Assuming Foster uses the individual-items approach for LCM computations, the inventory carrying value is $ and the company will record a $ loss adjustment Requirement b. Prepare the journal entry to record any write-down required using the indirect method. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Year-end Foster Factories, Inc. manufactures low-cost furniture. The company produces three sizes of wardrobes: 4 foot (S), 6 foot (M), and 8 foot (L). Foster provided the following data: Click the icon to view the data.) Read the requirements Requirement c. Determine the inventory carrying value with the lower-of-cost-or- market rule using the total inventory basis. (Enter a "0" if no LCM loss adjustment is required.) and the company will Assuming Foster uses the total inventory basis, the inventory carrying value is $ record a $ loss adjustment. Requirement d. Prepare the journal entry to record any write-down using the direct method. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Year-end Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts