Question: Please include lingo or excel in the solutions these questions, thanks. Instructions For this assignment, there is no LINGO. Excel is required for Question 2,

Please include lingo or excel in the solutions these questions, thanks.

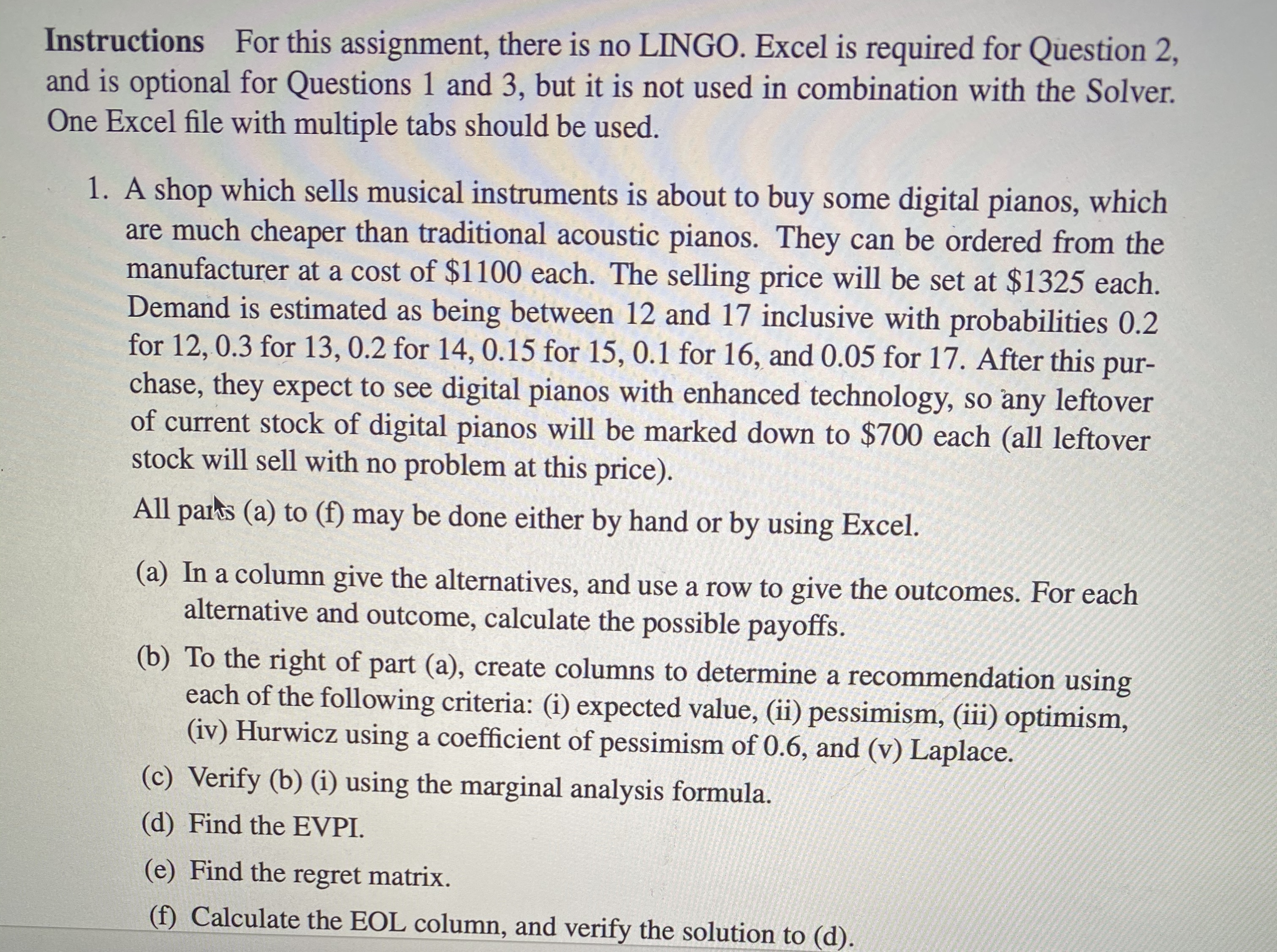

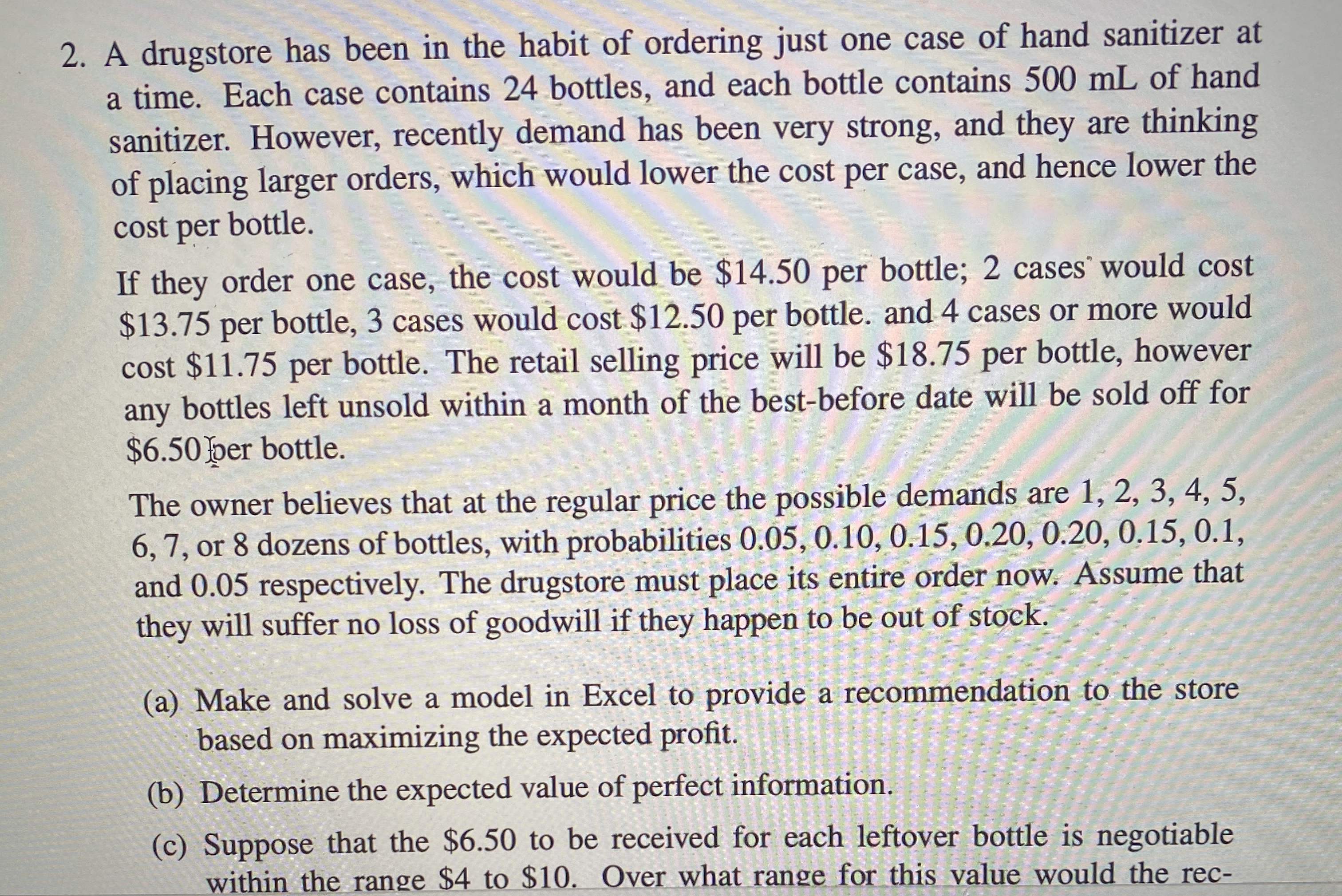

Instructions For this assignment, there is no LINGO. Excel is required for Question 2, and is optional for Questions 1 and 3, but it is not used in combination with the Solver. One Excel file with multiple tabs should be used. 1. A shop which sells musical instruments is about to buy some digital pianos, which are much cheaper than traditional acoustic pianos. They can be ordered from the manufacturer at a cost of $1100 each. The selling price will be set at $1325 each. Demand is estimated as being between 12 and 17 inclusive with probabilities 0.2 for 12, 0.3 for 13, 0.2 for 14, 0.15 for 15, 0.1 for 16, and 0.05 for 17. After this pur- chase, they expect to see digital pianos with enhanced technology, so any leftover of current stock of digital pianos will be marked down to $700 each (all leftover stock will sell with no problem at this price). All parks (a) to (f) may be done either by hand or by using Excel. (a) In a column give the alternatives, and use a row to give the outcomes. For each alternative and outcome, calculate the possible payoffs. (b) To the right of part (a), create columns to determine a recommendation using each of the following criteria: (i) expected value, (ii) pessimism, (iii) optimism, (iv) Hurwicz using a coefficient of pessimism of 0.6, and (v) Laplace. (c) Verify (b) (i) using the marginal analysis formula. (d) Find the EVPI. (e) Find the regret matrix. (f) Calculate the EOL column, and verify the solution to (d).2. A drugstore has been in the habit of ordering just one case of hand sanitizer at a time. Each case contains 24 bottles, and each bottle contains 500 mL of hand sanitizer. However, recently demand has been very strong, and they are thinking of placing larger orders, which would lower the cost per case, and hence lower the cost per bottle. If they order one case, the cost would be $14.50 per bottle; 2 cases would cost $13.75 per bottle, 3 cases would cost $12.50 per bottle. and 4 cases or more would cost $11.75 per bottle. The retail selling price will be $18.75 per bottle, however any bottles left unsold within a month of the best-before date will be sold off for $6.50 per bottle. The owner believes that at the regular price the possible demands are 1, 2, 3, 4, 5, 6, 7, or 8 dozens of bottles, with probabilities 0.05, 0.10, 0.15, 0.20, 0.20, 0.15, 0.1, and 0.05 respectively. The drugstore must place its entire order now. Assume that they will suffer no loss of goodwill if they happen to be out of stock. (a) Make and solve a model in Excel to provide a recommendation to the store based on maximizing the expected profit. (b) Determine the expected value of perfect information. (c) Suppose that the $6.50 to be received for each leftover bottle is negotiable within the range $4 to $10. Over what range for this value would the rec