Question: Please include step by step calculation and explain, not excel work! 1. It is 25 July 2022 ; you observe two treasury bills (a) What

Please include step by step calculation and explain, not excel work!

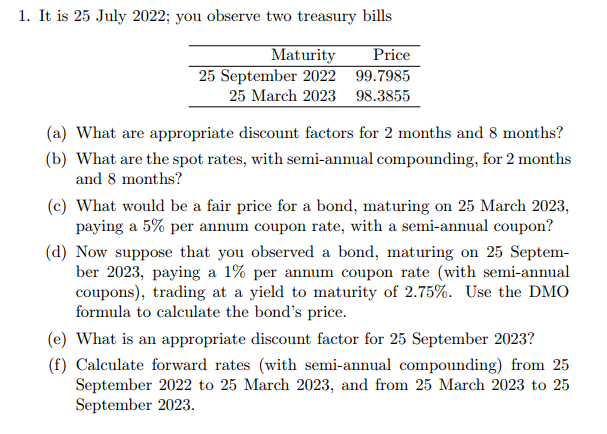

1. It is 25 July 2022 ; you observe two treasury bills (a) What are appropriate discount factors for 2 months and 8 months? (b) What are the spot rates, with semi-annual compounding, for 2 months and 8 months? (c) What would be a fair price for a bond, maturing on 25 March 2023, paying a 5% per annum coupon rate, with a semi-annual coupon? (d) Now suppose that you observed a bond, maturing on 25 September 2023, paying a 1% per annum coupon rate (with semi-annual coupons), trading at a yield to maturity of 2.75%. Use the DMO formula to calculate the bond's price. (e) What is an appropriate discount factor for 25 September 2023? (f) Calculate forward rates (with semi-annual compounding) from 25 September 2022 to 25 March 2023, and from 25 March 2023 to 25 September 2023 . 1. It is 25 July 2022 ; you observe two treasury bills (a) What are appropriate discount factors for 2 months and 8 months? (b) What are the spot rates, with semi-annual compounding, for 2 months and 8 months? (c) What would be a fair price for a bond, maturing on 25 March 2023, paying a 5% per annum coupon rate, with a semi-annual coupon? (d) Now suppose that you observed a bond, maturing on 25 September 2023, paying a 1% per annum coupon rate (with semi-annual coupons), trading at a yield to maturity of 2.75%. Use the DMO formula to calculate the bond's price. (e) What is an appropriate discount factor for 25 September 2023? (f) Calculate forward rates (with semi-annual compounding) from 25 September 2022 to 25 March 2023, and from 25 March 2023 to 25 September 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts