Question: Please include step by step inctruction for this if possible - Thank you very much. 11-42 NPV, IRR, and Payback Long Lake Dairy King is

Please include step by step inctruction for this if possible - Thank you very much.

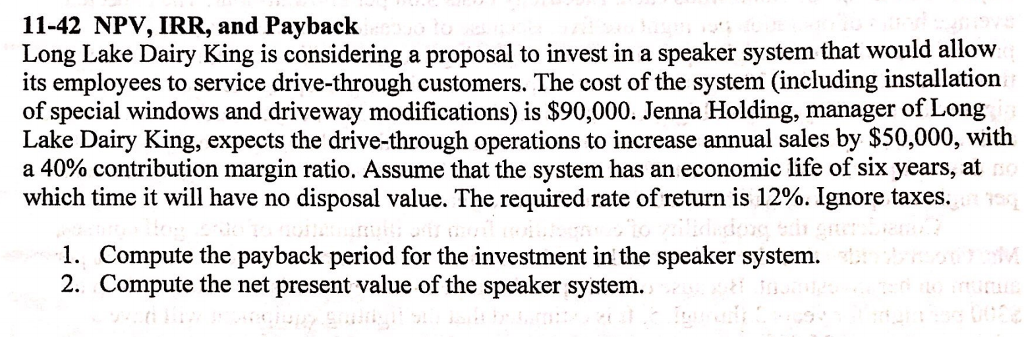

11-42 NPV, IRR, and Payback Long Lake Dairy King is considering a proposal to invest in a speaker system that would allow its employees to service drive-through customers. The cost of the system (including installation of special windows and driveway modifications) is $90,000. Jenna Holding, manager of Long Lake Dairy King, expects the drive-through operations to increase annual sales by $50,000, with a 40% contribution margin ratio. Assume that the system has an economic life of six years, at which time it will have no disposal value. The required rate of return is 12%. Ignore taxes. 1. 2. Compute the payback period for the investment in the speaker system. Compute the net present value of the speaker system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts