Question: Please include step by step instructions and round 2 decimal places You are the financial analyst for the Glad It's Finally Over Company. The director

Please include step by step instructions and round 2 decimal places

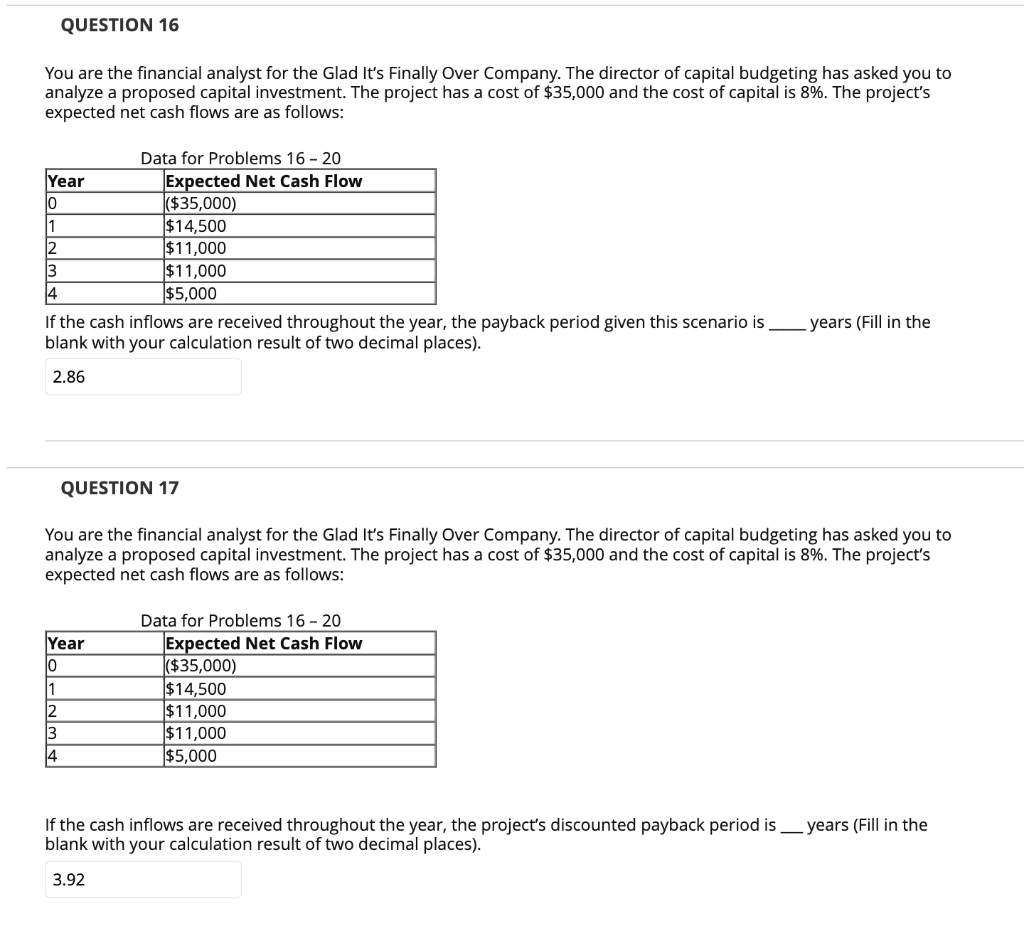

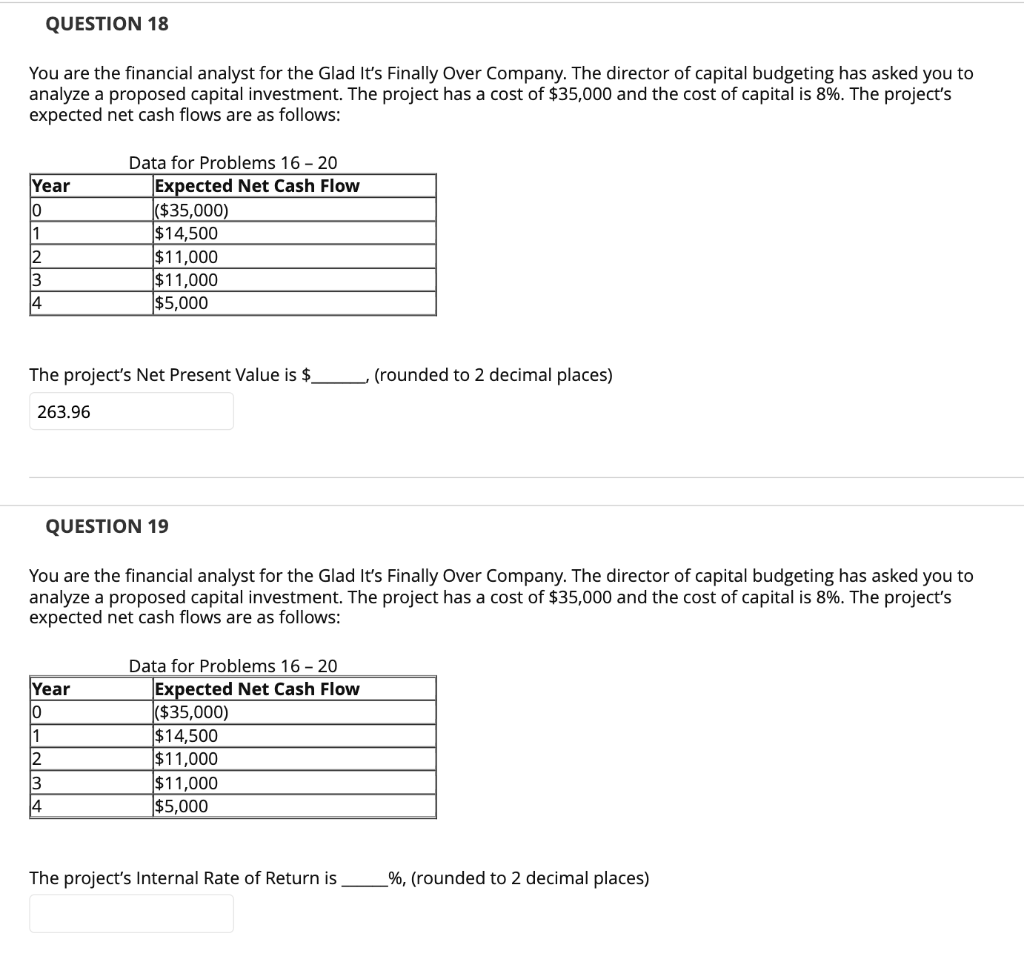

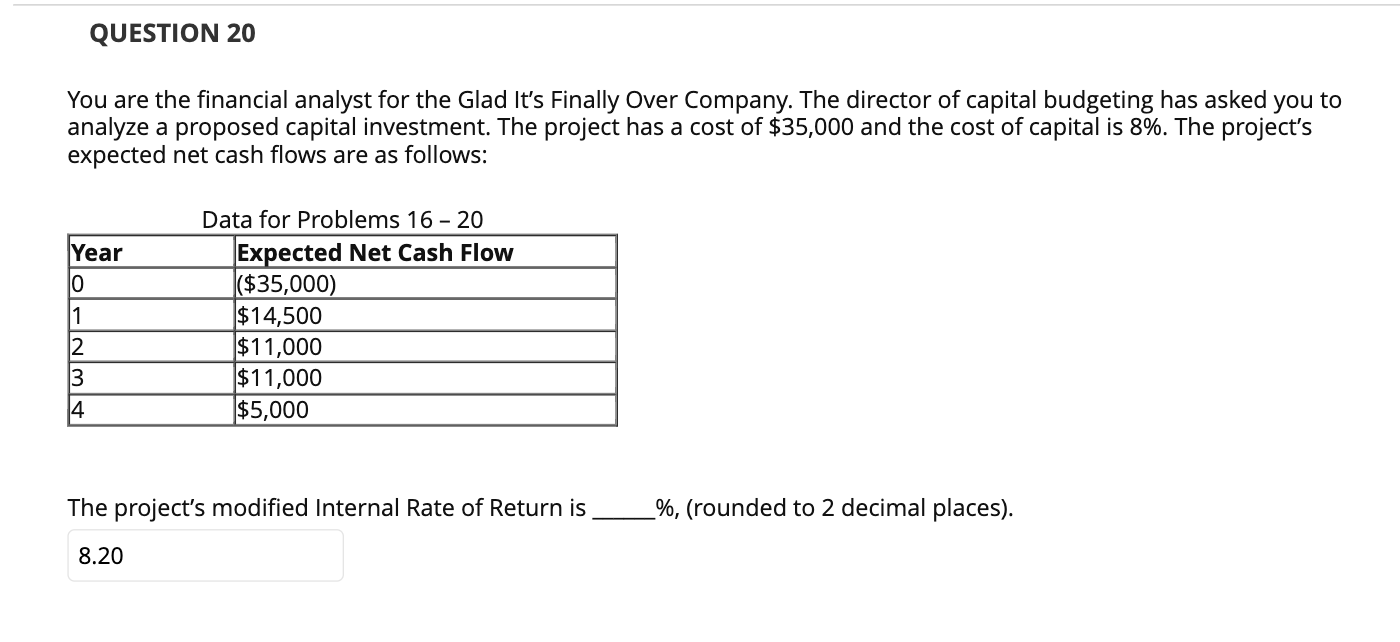

You are the financial analyst for the Glad It's Finally Over Company. The director of capital budgeting has asked you to analyze a proposed capital investment. The project has a cost of $35,000 and the cost of capital is 8%. The project's expected net cash flows are as follows: Nata for Prohleme 1620 If the cash inflows are received throughout the year, the payback period given this scenario is years (Fill in the blank with your calculation result of two decimal places). QUESTION 17 You are the financial analyst for the Glad It's Finally Over Company. The director of capital budgeting has asked you to analyze a proposed capital investment. The project has a cost of $35,000 and the cost of capital is 8%. The project's expected net cash flows are as follows: If the cash inflows are received throughout the year, the project's discounted payback period is years (Fill in the blank with your calculation result of two decimal places). You are the financial analyst for the Glad It's Finally Over Company. The director of capital budgeting has asked you to analyze a proposed capital investment. The project has a cost of $35,000 and the cost of capital is 8%. The project's expected net cash flows are as follows: The project's Net Present Value is : (rounded to 2 decimal places) QUESTION 19 You are the financial analyst for the Glad It's Finally Over Company. The director of capital budgeting has asked you to analyze a proposed capital investment. The project has a cost of $35,000 and the cost of capital is 8%. The project's expected net cash flows are as follows: The project's Internal Rate of Return is \%, (rounded to 2 decimal places) You are the financial analyst for the Glad It's Finally Over Company. The director of capital budgeting has asked you to analyze a proposed capital investment. The project has a cost of $35,000 and the cost of capital is 8%. The project's expected net cash flows are as follows: Data for Probleme 1620 The project's modified Internal Rate of Return is %, (rounded to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts