Question: Please include step by step instructions Questions 13 to 16 are based on the following scenario: The table below shows the option book for the

Please include step by step instructions

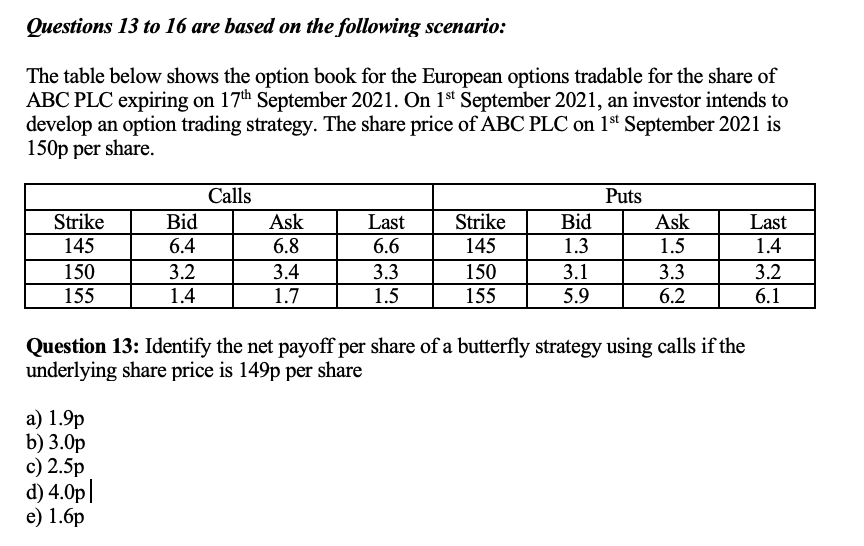

Questions 13 to 16 are based on the following scenario: The table below shows the option book for the European options tradable for the share of ABC PLC expiring on 17th September 2021. On 1st September 2021, an investor intends to develop an option trading strategy. The share price of ABC PLC on 1st September 2021 is 150p per share. Calls Puts Strike 145 150 155 Bid 6.4 3.2 1.4 Ask 6.8 3.4 1.7 Last 6.6 3.3 1.5 Strike 145 150 155 Bid 1.3 3.1 5.9 Ask 1.5 3.3 6.2 Last 1.4 3.2 6.1 Question 13: Identify the net payoff per share of a butterfly strategy using calls if the underlying share price is 149p per share a) 1.9p b) 3.0p c) 2.5p d) 4.0p| e) 1.6p Questions 13 to 16 are based on the following scenario: The table below shows the option book for the European options tradable for the share of ABC PLC expiring on 17th September 2021. On 1st September 2021, an investor intends to develop an option trading strategy. The share price of ABC PLC on 1st September 2021 is 150p per share. Calls Puts Strike 145 150 155 Bid 6.4 3.2 1.4 Ask 6.8 3.4 1.7 Last 6.6 3.3 1.5 Strike 145 150 155 Bid 1.3 3.1 5.9 Ask 1.5 3.3 6.2 Last 1.4 3.2 6.1 Question 13: Identify the net payoff per share of a butterfly strategy using calls if the underlying share price is 149p per share a) 1.9p b) 3.0p c) 2.5p d) 4.0p| e) 1.6p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts