Question: Please include steps and explanations, thank you Assume that the public debt in an economy is equal to 100% of GDP. Government spending (without interest

Please include steps and explanations, thank you

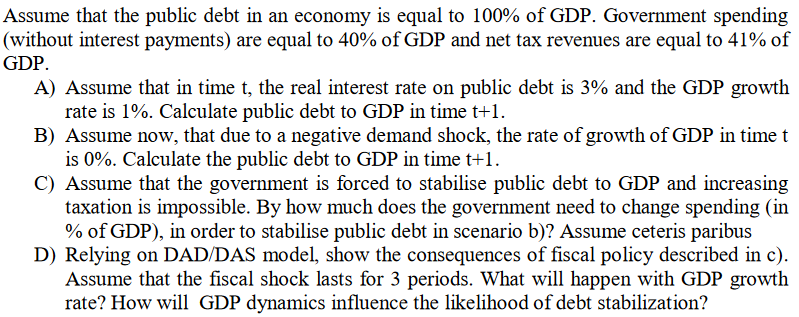

Assume that the public debt in an economy is equal to 100% of GDP. Government spending (without interest payments) are equal to 40% of GDP and net tax revenues are equal to 41% of GDP. A) Assume that in time t, the real interest rate on public debt is 3% and the GDP growth rate is 1%. Calculate public debt to GDP in time t+1. B) Assume now, that due to a negative demand shock, the rate of growth of GDP in time t is 0%. Calculate the public debt to GDP in time t+1. C) Assume that the government is forced to stabilise public debt to GDP and increasing taxation is impossible. By how much does the government need to change spending (in % of GDP), in order to stabilise public debt in scenario b)? Assume ceteris paribus D) Relying on DAD/DAS model, show the consequences of fiscal policy described in c). Assume that the fiscal shock lasts for 3 periods. What will happen with GDP growth rate? How will GDP dynamics influence the likelihood of debt stabilization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts