Question: Please include steps and explanations, thank you ' In December 201 the company BATA purchased (for cash) a four years licence for toys production. The

Please include steps and explanations, thank you

'

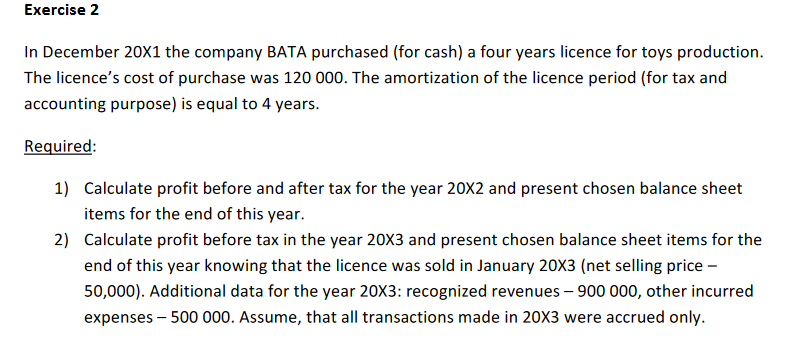

In December 201 the company BATA purchased (for cash) a four years licence for toys production. The licence's cost of purchase was 120000 . The amortization of the licence period (for tax and accounting purpose) is equal to 4 years. Required: 1) Calculate profit before and after tax for the year 202 and present chosen balance sheet items for the end of this year. 2) Calculate profit before tax in the year 203 and present chosen balance sheet items for the end of this year knowing that the licence was sold in January 203 (net selling price 50,000 ). Additional data for the year 20X3: recognized revenues 900000, other incurred expenses 500000. Assume, that all transactions made in 203 were accrued only. In December 201 the company BATA purchased (for cash) a four years licence for toys production. The licence's cost of purchase was 120000 . The amortization of the licence period (for tax and accounting purpose) is equal to 4 years. Required: 1) Calculate profit before and after tax for the year 202 and present chosen balance sheet items for the end of this year. 2) Calculate profit before tax in the year 203 and present chosen balance sheet items for the end of this year knowing that the licence was sold in January 203 (net selling price 50,000 ). Additional data for the year 20X3: recognized revenues 900000, other incurred expenses 500000. Assume, that all transactions made in 203 were accrued only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts