Question: Please include steps by step for both questions. Thank you. 5. While she was a college student, Angel lived by a bookstore located near campus.

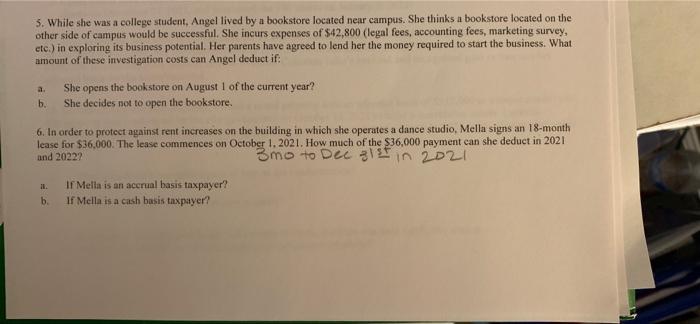

5. While she was a college student, Angel lived by a bookstore located near campus. She thinks a bookstore located on the other side of campus would be successful. She incurs expenses of $42,800 (legal fees, accounting fees, marketing survey. etc.) in exploring its business potential. Her parents have agreed to lend her the money required to start the business. What amount of these investigation costs can Angel deduct if: She opens the bookstore on August 1 of the current year? b. She decides not to open the bookstore. 6. In order to protect against rent increases on the building in which she operates a dance studio, Mella signs an 18-month lease for $36,000. The lease commences on October 1, 2021. How much of the $36,000 payment can she deduct in 2021 and 20222 3 mo to Dec 31st in 2021 if Mella is an accrual basis taxpayer? b. If Mella is a cash basis taxpayer? il

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts