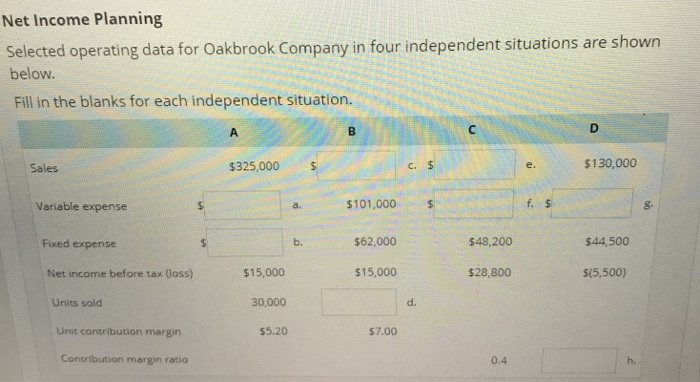

Question: Please include steps for each box Net Income Planning Selected operating data for Oakbrook Company in four independent situations are shown below Fill in the

Net Income Planning Selected operating data for Oakbrook Company in four independent situations are shown below Fill in the blanks for each independent situation. $325,000 $ $130,000 Sales C. e. $101,000 $62,000 $15,000 Variable expense g. Fixed expense b. $48,200 $44500 $15,000 30,000 $5.20 Net income before tax (loss) $28,800 s(5,500) Units sold d. Unit contribution margin $7.00 Contribution margin ratio 0.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts