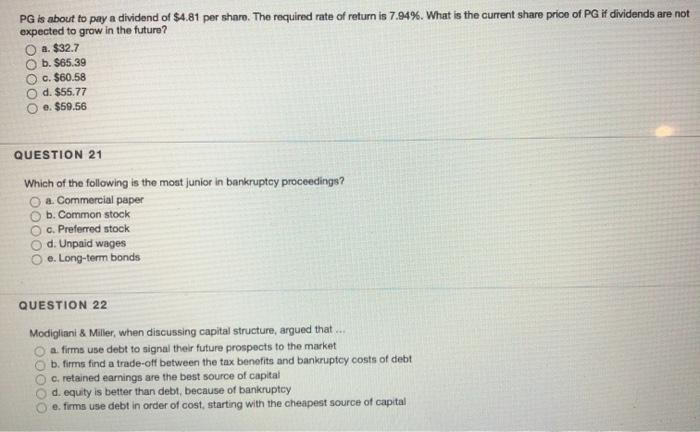

Question: Please include steps! PG is about to pay a dividend of $4.81 per sharo. The required rate of return is 7.94%. What is the current

PG is about to pay a dividend of $4.81 per sharo. The required rate of return is 7.94%. What is the current share price of PG if dividends are not expected to grow in the future? a. $32.7 b. $65.39 c. $60.58 d. $55.77 e. $59.56 QUESTION 21 Which of the following is the most junior in bankruptey proceedings? a Commercial paper b. Common stock c. Preferred stock d. Unpaid wages e. Long-term bonds OOOOO QUESTION 22 Modigliani & Miller, when discussing capital structure, argued that ... a firms use debt to signal their future prospects to the market b. firms find a trade-off between the tax benefits and bankruptcy costs of debt c. retained earnings are the best source of capital d. equity is better than debt, because of bankruptcy e. firms use debt in order of cost, starting with the cheapest source of capital DOC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts