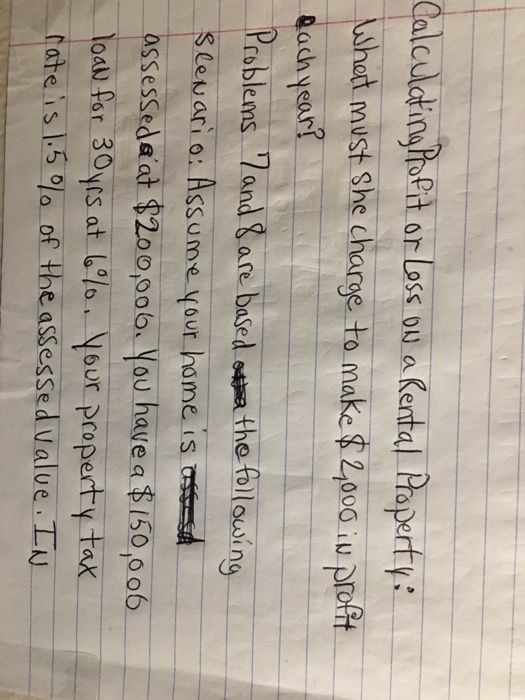

Question: Please include steps. Thanks. Calculating Profit or loss ow a Rental Property: What must she charge to make $2,000 in profit each year! Problems 7

Calculating Profit or loss ow a Rental Property: What must she charge to make $2,000 in profit each year! Problems 7 and 8 are based on the following slenario: Assume your home is used assessede'at $200,006. You have a $150,006 load for 30yrs at 6%. your property tax rate is 1.5% of the assessed value. In Year One you would pay $9,000 in mortgage interest and $3000 in property tax [1,5 % EN ON $200,000 assessed value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts